In today’s industry, contract development and manufacturing organisations (CDMOs) are not the optional extra at the edge of the supply chain; they are the backbone of it.

Sponsors are leaning more heavily than ever on external partners to provide the scale, expertise and resilience they cannot maintain internally.

In many instances, CDMOs are not only keeping pace with sponsor expectations but surpassing them by offering technical breadth, regional redundancy and delivery models that enable new therapies to reach patients faster.

This shift has been building for some time, reports Tim Roberts (pictured), Chief Commercial Officer at PCI Pharma Services.

The rise of biologics and injectable therapies, the long aftershocks of COVID-19 and the steady political drumbeat regarding supply chain security have pushed outsourcing from tactical to strategic.

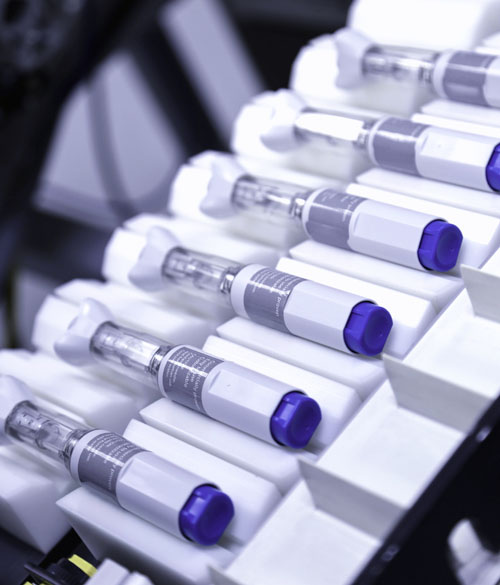

Patient-centric delivery formats, from prefilled syringes to wearable injectors, have accelerated the trend. Demand for the integration of device engineering, usability studies and regulatory expertise that many pharma companies cannot support in-house is on the rise.

Add to that the tighter capital environment that limits the ability of biotech companies to fund their own infrastructure and the case for outsourcing is stronger than ever.

The result is an industry at an inflexion point. Outsourcing is no longer a way to release pressure; it is the lever that defines whether sponsors can scale, adapt and deliver in an increasingly complex environment.

Why outsourcing has become inevitable

The drivers are multifaceted but mutually reinforcing. The therapeutic pipeline is dominated by modalities that demand advanced capabilities: GLP-1 receptor agonists are reshaping obesity and diabetes care, antibody-drug conjugates (ADCs) are revolutionising oncology and targeted protein degraders (TPDs) are opening new possibilities in immunology.

Each comes with intricate manufacturing requirements, from high-potency containment to advanced fill‑finish and analytical control. Few sponsors can justify building — let alone mastering — these capabilities internally.

COVID-19 reinforced the fragility of global supply chains, exposing vulnerabilities in everything from sterile capacity to the availability of glass and elastomer components.

Regulators took note. What was once considered to be a crisis-driven expansion has now become a structural expectation: redundancy, surge capacity and agility are built into inspection frameworks and policy initiatives.

Sponsors that lack this resilience themselves must find it by engaging outsourcing partners. At the same time, the shift toward patient self-administration has transformed delivery expectations. Autoinjectors, wearable systems and home-based administration are not “nice to haves” but core features of modern therapy.

For sponsors, that means navigating device integration, usability testing and supply continuity in markets that expect reliability on par with consumer electronics.

CDMOs that invest in device assembly and quality systems can deliver these expectations more effectively than individual sponsors replicating the infrastructure in-house.

And then there is geopolitics. Initiatives such as the US BioSecure Act are already influencing investment decisions, driving sponsors to re-examine where and how their critical medicines are produced.

The demand for onshore or near-shore supply is rising, rewarding CDMOs with regionally redundant capacity and harmonised quality systems across continents. For smaller sponsors, building that level of redundancy internally is simply out of reach.

The financial environment only sharpens the case. With investment capital more constrained, biotech companies are increasingly forced to focus resources on their most promising candidate, rather than hedging across multiple programmes.

In that context, outsourcing becomes the natural way to derisk timelines, maintain optionality and preserve working capital.

What outsourcing should deliver

When sponsors choose to outsource, they are not simply looking for spare capacity; they are seeking outcomes. The best CDMOs understand this and deliver value in three ways. First, quality must be uncompromising.

In sterile manufacturing, regulators have shown little patience for lapses in aseptic practice, data integrity or contamination control.

The cost of failure is measured not only in warning letters and market withdrawals but in the erosion of patient trust.

For a sponsor, selecting an outsourcing partner is therefore as much a question of risk management as cost or speed. Second, outsourcing must accelerate decision making.

The point is not to generate more data but to provide the expert judgment and transparent options that allow sponsors to move quickly on lot sizes, supplier substitutions or changeover strategies.

Increasingly, digital platforms play a role here, giving sponsors live visibility into capacity, material status and risk signals. The value of outsourcing is magnified when decisions that might once have taken weeks can be made in days or hours.

Finally, the outsourcing model must resolve the traditional tension between flexibility and scale. Sponsors need intimate attention during early phase development but also require rapid ramp-up into high-throughput commercial supply when a product succeeds.

CDMOs that operate decentralised networks with harmonised quality systems are best placed to meet that need, offering both the boutique focus of smaller operations and the safety net of global capacity.

The practical impact of outsourcing

These principles come alive in the specific areas where outsourcing is transforming sponsor pipelines. Injectable and device integration capabilities now rival aerospace engineering in precision, with high-speed assembly lines capable of producing hundreds of finished devices per minute.

This is not infrastructure that most sponsors can build for themselves, but it’s critical to the success of GLP-1s, biosimilars and a new generation of self-administered therapies. In oral solid dose (OSD) manufacturing, outsourcing plays a different but equally vital role.

Potent small molecules remain central to oncology pipelines, yet the handling and containment requirements for highly potent active pharmaceutical ingredients (HPAPIs) are substantial.

Sponsors avoid hard choices between accounts by leaning on CDMOs that have invested early in dedicated high-potency OSD capacity. Lyophilisation is another area in which outsourcing proves decisive.

Freeze-drying is both a science and an art: cycle design, cake morphology and residual moisture all shape stability and reconstitution performance.

Sponsors rarely have in-house teams with deep lyophilisation expertise, but outsourcing partners can provide both scale and process development insight.

Clinical trial supply (CTS) is perhaps the most overlooked but most strategic outsourcing arena.

Managing thousands of trials gives CDMOs a forward view of which modalities are poised for commercial success, while also enabling speed and compliance in a highly fragmented global supply environment.

Sponsors benefit not just from logistics but from intelligence — seeing what’s coming down the pipeline years before it hits the market.

Partnership as a differentiator

Outsourcing, at its best, is not subcontracting — it’s a partnership. That means aligning three elements:

- the drug itself, with its formulation and critical quality attributes

- the technology that supports it, from equipment to analytics

- the people who execute the work, from process scientists to operators on the floor.

When sponsors outsource, they are buying more than machine hours. They are buying the expertise that prevents failures, the transparency that builds trust and the culture of responsiveness that ensures that small biotechs feel as valued as Big Pharma.

Many of the most successful CDMOs have retained the entrepreneurial reflexes of their founder-led origins … and sponsors recognise the difference.

Looking ahead: the next wave of outsourcing

The therapies now in development will test the CDMO model in new ways. Antibody-drug conjugates, for instance, combine the specificity of biologics with the potency of cytotoxics, thereby demanding specialised containment and conjugation-friendly workflows.

Outsourcing partners that can provide this without overengineering — and therefore overpricing — will determine whether many ADC programmes are commercially viable.

Rare disease therapies and ultra-niche oncology products bring a different challenge: volume. Many will never require more than a few thousand vials annually.

For sponsors, outsourcing offers the only sustainable route to cost-effective small-batch production without compromising the ability to scale-up when needed. Meanwhile, new oral modalities such as targeted protein degraders are advancing rapidly.

Their promise lies in harnessing the body’s own protein disposal systems, but their development demands innovative formulation, stability and bioavailability solutions.

Outsourcing partners that combine high-potency expertise with advanced analytics and patient-centric delivery options will be essential to moving these therapies forward.