With the continuous increase in industry outsourcing, along with pressure to optimise costs, the biopharmaceutical industry is more discerning and stringent than ever in its methods of choosing an outsourcing partner. In this highly competitive industry with stringent safety regulations and an urgency to develop more products in less time, the job of selecting a CRO or CMO is critical.

According to Nice Insight’s 2015 survey of pharmaceutical, biotechnology and medical device companies in North America and Europe,1 the highest-ranking method employed to select a contract research and/or manufacturing company is industry research, used by more than two-thirds of industry companies (67%). Hiring consultants to find the most suitable match for their needs (59%) and referrals from colleagues (54%) ranked second and third, respectively.

Attendance at industry trade shows and events (40%) and publications (36%) were also used, but are regarded as less important or reliable tools in the selection process. Trade shows provide an opportunity to meet with representatives of CROs and CMOs.

Industry research is the primary selection tool used by all groups: big pharma, speciality pharma, emerging pharma, biotech, emerging biotech, medical device and generics/biosimilars companies

Use of online directories (24%) and web searches (18%) were the least-used screening methods. This is probably because many companies remain somewhat sceptical about the credibility of online search tools, including social media. While these tools may convey capabilities and contact details, the information typically derives from CROs and CMOs, so it is not unbiased.

Rankings by buyer group do not vary significantly from the overall industry rankings, with industry research the primary selection tool used by all groups: big pharma, speciality pharma, emerging pharma, biotech, emerging biotech, medical device and generics/biosimilars companies. Big pharma relies more heavily on referrals (59%) compared with other groups, particularly generics/biosimilars companies (44%), and big pharma and biotech companies depend more on advice from consultants than other groups.

Emerging biotech companies rely more heavily on industry research (72%) compared with other groups, particularly more than generics/biosimilars companies at 53%. Rankings by North American pharma/biotech companies are closely aligned with those of European companies.

Industry trade shows are broadly attended by companies of all types and throughout the world in the pharmaceutical and biotechnology industries. Scientists attend the presentations and exhibits to gain knowledge and learn about the latest methods and technologies.

At many of the conferences, marketers and executives staff exhibition booths, expending a large portion of their marketing budget to demonstrate and explain their products and services directly to potential buyers. Others attend to network with industry colleagues, meet with outsourcing partners, and research contract organisations as potential service providers.

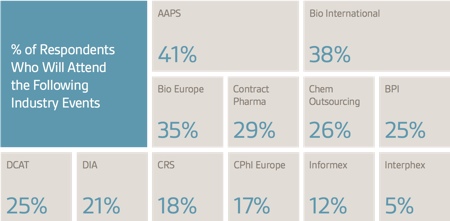

In Nice Insight’s 2015 survey, the most broadly attended trade show in terms of buyer groups is the American Association of Pharmaceutical Scientists (AAPS) Annual Meeting and Exposition, with 41% of companies who attend trade shows including this one on their show roster. The total attendance at the fall 2014 AAPS Annual Meeting was 7,358, including exhibitors, with 5,929 from the US and the remainder from about 60 countries.

The biotech and emerging biotech sectors appear to place a higher importance on trade show attendance than other groups

Ranking next in terms of attendance among this group in 2014 were BIO International, (Biotechnology Industry Organisation) with 38% and BIO Europe (Biotechnology Partnering Conference) with 35% of companies who attend trade shows. The next lower tier in attendance includes the Contract Pharma Contracting & Outsourcing Conference (29%), ChemOutsourcing (26%), as well as the DCAT Week Conference (Drug, Chemical & Associated Technologies) and BPI (BioProcess International) Conference, both at 25%. Only 12% of companies attending meetings include Informex, while 5% attend Interphex.

The attendance pattern in nearly all buyer groups is similar to the overall rankings listed above, with AAPS in the lead, followed by BIO International and BIO Europe in most cases. The exception is speciality pharma, which ranks the Contract Pharma Conference highest (34%) on its attendance preference.

The biotech and emerging biotech sectors appear to place a higher importance on trade show attendance than other groups, with 50% and 45% of trade show attendance at AAPS respectively, and 47% for emerging biotech and 43% for biotech companies attending BIO International. Emerging biotech also ranks BPI, ChemOutsourcing and the Contract Pharma Conference higher on its attendance ranking compared with other business sectors.

Comparing regions for trade show attendance, nearly half of companies in North America attend AAPS, and 16% are from Europe. The second-highest ranking in attendance for North American companies is BIO International (40%), and third is BIO Europe at 32%.

In Europe, the leading shows are BIO Europe (45%), followed by BIO International at 31%. CPhI Worldwide, with the highest total attendance of more than 36,000 attendees from 140 countries according to United Business Media, also draws 17% of North American buyers and 26% of European buyers surveyed. It is interesting to note that extremely few companies did not plan to attend any trade shows in 2014/2015. Emerging pharma ranked highest in this category with 10%.

Survey methodology

The Nice Insight Pharmaceutical and Biotechnology Survey is deployed to outsourcing-facing pharmaceutical and biotechnology executives on an annual basis. The 2014-2015 report includes responses from 2,303 participants. The survey is comprised of 240+ questions and randomly presents ~35 questions to each respondent to collect baseline information with respect to customer awareness and customer perceptions of the top ~125 CMOs and ~75 CROs servicing the drug development cycle.

Five levels of awareness, from ‘I’ve never heard of them’ to ‘I’ve worked with them’ factor into the overall customer awareness score. The customer perception score is based on six drivers in outsourcing: Quality, Innovation, Regulatory Track Record, Affordability, Productivity and Reliability. In addition to measuring customer awareness and perception information on specific companies, the survey collects data on general outsourcing practices and preferences as well as barriers to strategic partnerships among buyers of outsourced services.

Reference

1. 2015 Pharmaceutical and Biotechnology Outsourcing Survey, Nice Insight, January 2015 http://www.niceinsight.com