Outsourcing saw an exciting year in 2015, as the demands from pharma and biotech companies for external research, development and manufacturing services have never been greater. According to the 2016 Nice Insight CRO and CDMO Outsourcing surveys of 1,173 industry representatives from pharma and biotech companies, some key trends driving the significant rise in outsourcing budgets this year are:

- Changing pipelines, with growth in biologics, complex therapies and delivery systems, and more specialised medicines.

- The need for new types of services, advanced technologies and expertise.

- Strong growth and spending by pharmaceutical and biotech companies for outsourcing services.

- Quality compliance and on-time delivery are important criteria for choosing service providers.

In terms of changing product pipelines, about two-thirds of companies (66%) focus on large molecules as new biological entities (NBEs), surpassing small molecule products (NCEs) at 57%, while 53% focus on small molecule generics and half on biosimilars. Of the companies concentrating on large molecules, their main product types are antibody drug conjugates and vaccines, followed closely by hormones, blood factors and growth factors.

As the biopharmaceutical market continues to grow, more and more firms are calling on the services of CMOs and CDMOs for technical expertise, operational efficiency, regulatory support, and cost efficiency. Driven by this strong growth and advancement in technologies, biopharmaceutical CDMOs are well positioned to achieve accelerated growth in the coming years.

The growth in demand for biopharma CDMO services results in part from new drug commercialisation, higher funding rates of biotech companies, and expanding service offerings by biopharmaceutical CMOs

The market for biopharma contract services is expected to reach US$3bn in 2016, and growth is expected to continue over the next few years. Many of these service providers are either investing in new plants and equipment or acquiring capacity to meet future industry needs. The growth in demand for biopharma CDMO services results in part from new drug commercialisation, higher funding rates of biotech companies, and expanding service offerings by biopharmaceutical CMOs.1

With an estimated $67bn of patents on biological products expiring by 2020, biosimilars represent a major opportunity for the pharmaceutical industry and market growth is expected to increase significantly.2 The first FDA-approved biosimilar (Zarxio from Novartis) received clearance on 5 March 2015. Many in the industry are waiting for the regulatory track record to expand so that further approvals can come more quickly.

Of the companies who outsource or are planning to outsource services to CDMOs/CMOs for product development and/or manufacturing, most (79%) do so for drug product research, development and manufacturing of both small and large molecules. These services include drug product dosage manufacturing (such as solid, liquid, injectable, based on the delivery route), and packaging services, such as blisterpacking, bottling, tube filling and labelling. The survey also showed that 68% utilise these same services for drug substances, half use or plan to tap them for specialised services, and 40% are interested in outsourcing lab-based services.

The oral solid dose form continues to play a major role for contract manufacturing, and is set for a new period of gradual expansion. According to the Nice Insight surveys, for clinical-scale manufacturing, more than three-quarters of companies outsource solid dosage forms, followed by semi-solids and liquids. The same is true for commercial-scale manufacturing, with nearly two-thirds of companies seeking services for solid dosage forms, followed closely by semi-solid and liquid dosage forms (60%). Fixed-dose combinations, controlled-release dosage forms and other lifecycle management strategies will continue to have significance.3

Advanced technical capabilities and expertise continue to be important criteria for outsourcing relationships

When outsourcing research services, most companies engage or plan to engage CDMOs for Phase II clinical development, followed to a lesser degree by Phase III, Phase I and preclinical research, according to the 2016 survey. This is a reversal from the 2015 Nice Insight survey, when most companies outsourced pre-clinical and Phase I studies, followed by Phase II and to a lesser degree, Phase III. Of those who outsource Phase IV/Post Launch studies to extend the life of their commercial products, the vast majority (85%) do so for controlled-release services.

Advanced technical capabilities and expertise continue to be important criteria for outsourcing relationships, but differentiation through these offerings must be combined with flexible, tailored support and close co-operation.

Looking at packaging trends, most companies outsource clinical and commercial scale primary packaging; far fewer outsource secondary packaging and fill-finish services. The most commonly outsourced packaging services are labelling, controlled room temperature packaging, and package design and development, followed closely by anticounterfeiting, bottling, and compliance and adherence solutions.

To enhance drug delivery techniques for BCS class II–IV compounds, most companies look to CDMOs and CMOs to develop controlled-release formulations. In response, some CDMOs are expanding their array of enhanced drug-delivery technologies to give their customers broader options. These delivery technologies may include various targeted and timed release/dissolution and formulation technologies.

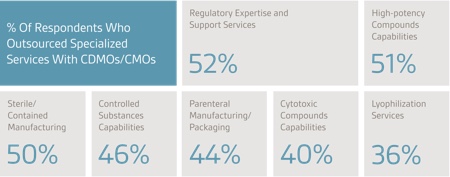

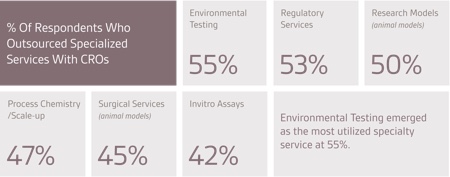

Companies seeking specialised services from outsourcing organisations are primarily looking for regulatory expertise, high-potency compound capabilities and sterile/contained manufacturing. The most widely outsourced laboratory service is process development and optimisation, followed by pre-formulation and formulation.

The primary reason most companies engage outsource organisations is to improve quality – the same reason cited over the past few years as the top priority when selecting a service provider. Only emerging pharma companies ranked reducing financial outlay and lowering the risk of supply shortages slightly higher. Other significant reasons for outsourcing revealed in the Nice Insight 2016 surveys are improving efficiency, reducing costs and improving time to market.

When establishing an initial list of prospective CDMOs and/or CMOs as partners, the most important selection criteria are the provider’s regulatory compliance, demonstrating an under-standing of the company’s requirements, financial stability, industry reputation, experience and taking a contractual approach to assure IP protection. All these rank higher than cost.

The majority of companies (70%) would consider outsourcing to contract service providers in emerging markets. Companies that have not considered outsourcing projects to emerging markets cite the primary reason as regulatory compliance concerns. Others believe the quality is too risky or have IP or communication concerns. The survey also shows that nearly one-third of outsourced services are in the US and Canada. Less than half that amount is outsourced to Western Europe or India.

After engaging a service provider, there are multiple evaluation criteria that companies consider equally important, with quality compliance and on-time delivery topping the list. Other high-ranking criteria are customer service and meeting the project deliverable. The majority of companies of all types are satisfied with the CDMO they are currently working with.

What has been most disappointing to companies regarding service providers’ performance is the product and/or service quality, followed by lack of security or confidentiality, timeliness of resolving issues, and cost overruns. Companies would consider changing service providers primarily to obtain better quality. Other reasons for changing are better timelines, operational expertise and prices.

In 2016, 43% of companies are looking for a preferred provider relationship, but preferences vary by company type. Almost equally, the priorities for big pharma and biotech are preferred provider and strategic partner relationships, while emerging companies (65%) still prefer tactical service providers. Most mid-sized companies choose preferred provider arrangements.

To realise efficiencies, industry companies are reducing the number of service providers to a preferred few. However, it is likely that a CDMO/CMO that started off as a tactical service provider will become a preferred provider, and a preferred provider will become a strategic partner. Nearly all companies (95%) indicated that they are interested in a strategic partnership with a CDMO/CMO in the next 12–18 months.

References

1. Downey W. Biopharmaceutical Contract Manufacturing Capacity Expansions. High Tech Business Decisions. Contract Pharma. June 2, 2015. Accessible at: http://www.contractpharma.com/issues/2015-06-01/view_features/biopharmaceutical-contract-manufacturing-capacity-expansions/

2. US$67bn worth of biosimilar patents expiring before 2020. Generics and Biosimilars Journal. Sept. 2012. Accessible at: http://gabi-journal.net/news/us67-billion-worth-of-biosimilar-patents-expiring-before-2020

3. 2016 Nice Insight Contract Research – Preclinical and Clinical Survey (CRO Outsourcing survey) and Nice Insight 2016 Contract Development & Manufacturing Survey (CDMO Outsourcing survey), January 2016.

To learn more about Nice Insight email nigel@thatsnice.com or visit www.niceinsight.com and the annual study websites: www.niceinsightcro.com, www.niceinsightcdmo.com, www.niceinsightexcipients.com and www.niceinsightpharmaequipment.com.