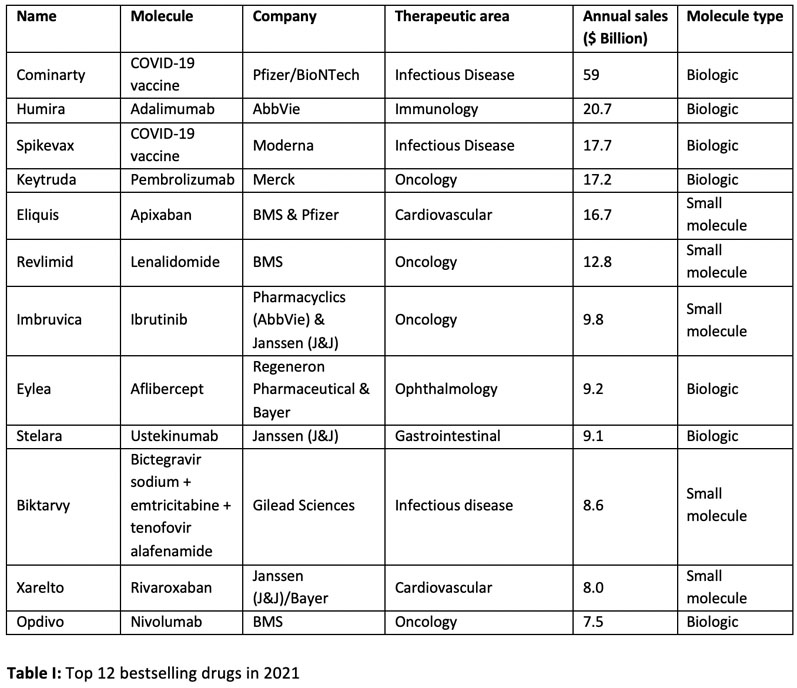

Of the top ten drugs sold worldwide in 2021, four were small molecules (Table I). However, with two of the top three bestsellers being COVID-19 vaccines, this skews the data slightly.1

The total sales value of these ten drugs is approximately $181 billion, which represents approximately 30% of the total market. Removing the two COVID-19 vaccines (Cominarty and Spikevax) and looking at the next two bestsellers — Xarelto and Opdivo — this splits the ten highest-selling drugs in a 50:50 ratio between small molecule and biologic-based drugs.

It is, however, impossible to ignore the rise of biologics since the first humanised insulin (5.8 kDa) became available in 1982. In the period from 2011 to 2017, biologic sales revenue grew by 70% to reach $232 billion and the share of the total pharmaceutical market that biologics held increased from 16% in 2006 (up to 25% in 2016).2

In 2017, however, only 2% of all US prescriptions were for biologics; yet, this accounted for 37% of net drug spending.3

The increase has continued since then, with predictions that the sales of biologics are to significantly overtake those of innovative small molecules during the next 5 years — with biologics sales forecast to be $120 billion greater than small molecule sales by 2027.4

Big-selling COVID-19 vaccines have obviously made an impact in recent data, but biologics sales are currently largely driven by monoclonal antibodies, which are forecast to account for 46% of all biologics sales in 2027.

When comparing small molecule revenue with that of biologics, it should be noted that small molecules constitute as much as 90% of global sales; on average, though, a daily dose of a biologic costs 22 times more than that of a small molecule.2

Despite the predicted growth of biologics, small molecule sales are also forecast to continue to grow by 49% in the next few years. The gap widens because of the increased costs of manufacturing biologics, but small molecules remain important to satisfy the growing demand for cost-effective drugs.

There is also an imbalance in the generics markets for each class: the industry is still in its early phase in terms of biosimilars and the generic erosion of the biologics market; in small molecules, it is already mature and benefits from a number of high-selling blockbusters that have come off patent or are about to become available as generics.

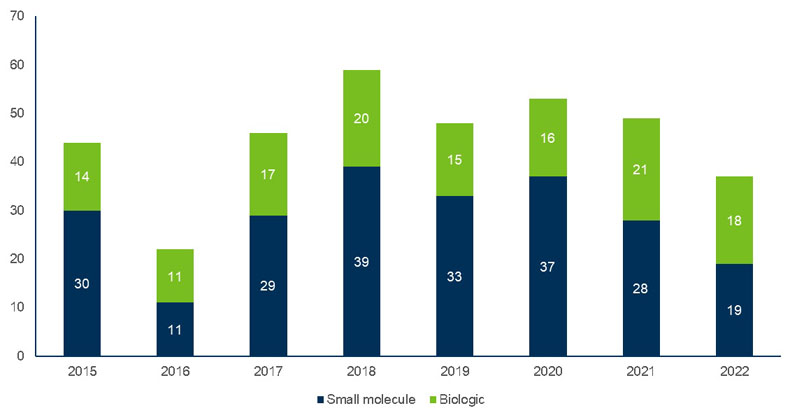

This overall industry growth is driven by the increasing number of drug approvals (Figure 1), which has the number of small molecules still outweighing biologics.5

Figure 1: Approvals by molecule type

As well as the approval numbers, the clinical pipeline across all therapeutics is healthy, especially in the small molecule arena. There are nearly 1000 molecules in Phase III and more than 2000 currently in Phase II throughout a wide range of therapeutic areas.6,7

Funding in the pharmaceutical industry remains strong; despite a lull during the last 2 years compared with the highs witnessed during the pandemic, investment still exceeds 2019 levels.8

Opportunities in small molecule manufacturing for CDMOs

The value of the global small molecule innovator CDMO market size was estimated to be $41.1 billion in 2020 and is predicted to rise to approximately $73.9 billion by 2030.9

Companies working in this arena will need to understand the prevailing trends to differentiate themselves in a crowded market … and be in a position to capitalise on the programmes in development. Investment in the correct areas and being in a position to assist developers throughout clinical development and on to commercialisation will be key to maximising returns.

Controlled substances: Controlled substances include innovator drugs as well as a range of generic actives including opioids, depressants, stimulants and cannabinoids.

They are used for a range of therapies including — but limited to — pain management, depression, post-traumatic stress disorder, attention deficit hyperactivity disorder, anxiety and other central nervous system conditions such as epilepsy.

Despite the movement to legalise cannabinoids in many US states, they are still considered to be controlled substances.

The requirements for a CDMO to operate a facility that can handle controlled substances are even more stringent than they are for a standard small molecule drug plant: there must be strict security throughout both production and storage, including steel vaults.

And perimeter security is also important, with impregnable fences and cameras being standard precautions. As well as investing in the necessary infrastructure, specific government licences are required for companies to handle and manufacture controlled substances.

Despite the turmoil in the opioid market, these (and other drugs treating the central nervous system) still predominate, representing more than 80% of all controlled substances. The cannabinoid CBD and the painkiller buprenorphine are notable growth areas in this sector.

There has also been a resurgence in interest in psychedelics as treatments for mental health disorders, particularly depression. The total global market size for controlled substances was estimated to be $84.44 billion in 2022, with the expectation of it growing to $142.11 billion by 2032.10

Highly potent APIs (HPAPIs): For drugs that require containment facilities, most developers lack the expertise or capabilities to handle them past small/laboratory scale. This leads to developers turning to manufacturing partners with the necessary capacity and technology to safely manufacture them — and justify the capital expenditure for multiple programmes to be undertaken within them.

Research shows that approximately 45% of all small molecule new chemical entities (NCEs) are highly potent; however, this does not include products in development.11 More than 25% of the total drugs worldwide are currently classified as highly potent, making HPAPI drugs one of the most prominent specialised segments of the pharmaceutical industry.12

Antibody-drug conjugates (ADCs) are products that combine an antibody with a biologically active small molecule drug; the former is used to precisely target the latter to the active site. There are 13 currently approved ADCs, but significant (and increasing) numbers are now in the clinic (with the majority targeting oncology indications).

As of the end of 2022, there were 167 clinically active ADC programmes and more than 400 in preclinical development.13 This clearly represents another growing market for the CDMO sector.

The small molecule part of the ADC is an HPAPI, which requires significant investment in containment within the manufacturing facility and also needs handling extremely carefully throughout, including when it is being conjugated to the antibody.

Small molecules, big future

The pharmaceutical industry is constantly changing and evolving, with new technologies and therapies being developed to meet the increasingly complex needs of patients.

However, outsourcing manufacturing will remain a vital part of the industry as it looks to accelerate development and increase efficiencies.

CDMOs will need to become flexible to match these changes and be willing to invest in ways that will suit the needs of future therapies.

Although in many cases it is difficult to identify whether the API for a small molecule drug has been manufactured in-house, outsourced or a hybrid of the two, forecasts from GlobalData indicate that new small molecule APIs are about twice as likely as biologics to be made by a contract manufacturer (at least when this has been disclosed).

This figure has remained relatively stable at approximately 50% for many years, with 48% of small molecules being outsourced in 2021 compared with to just 23% for biologics. Although not comprehensive, these data clearly indicate the continued importance of small molecules to the CDMO sector.

Despite some industry narratives suggesting that the rise of biologic-based drugs indicates the wide-scale decline of small molecule medicines, the market remains strong and still presents new opportunities for companies to support innovation through contract manufacturing.

The challenge that CDMOs have is to anticipate future market requirements and predict how small molecules will continue to evolve to remain important and relevant to modern therapeutics.

References

- www.drugdiscoverytrends.com/50-of-2021s-best-selling-pharmaceuticals/.

- www.biopharmatrend.com/post/67-will-small-molecules-sustain-pharmaceutical-race-with-biologics/.

- https://doi.org/10.1016/j.medidd.2020.100075.

- www.pharmaceutical-technology.com/comment/biologic-sales-small-molecule-sales/.

- www.fda.gov/drugs/development-approval-process-drugs/new-drugs-fda-cders-new-molecular-entities-and-new-therapeutic-biological-products.

- www.ncbi.nlm.nih.gov/pmc/articles/PMC6226120/ (Phase 1 = 75%, Phase II = 59%, Phase III = 88%; sample size of 786).

- www.fda.gov/patients/drug-development-process/step-3-clinical-research (Phase I = 70%, Phase II = 33%, Phase III = 25–30%).

- www.iqvia.com/insights/the-iqvia-institute/reports/global-trends-in-r-and-d-2023.

- www.biospace.com/article/small-molecule-innovator-cdmo-market-size-to-hit-us-73-9-billion-by-2030/.

- www.precedenceresearch.com/controlled-substance-market.

- https://affygility.com/potent-compound-corner/2021/07/09/percentage-of-drug-compounds-highly-potent.html.

- www.prnewswire.com/news-releases/hpapi-and-cytotoxic-drugs-manufacturing-market-3rd-edition-2020-2030-301057435.html.

- https://beacon-intelligence.com/infographic/the-2022-adc-landscape-review/.