Manufacturing Chemist got together with key opinion leaders at CDMOs including MedPharm, Sterling Pharma Solutions, TraceLink, Recipharm, Lubrizol, ChargePoint Technology, Tjoapack, Sharp Clinical Services, and Idifarma, to talk about established and emerging trends in the pharmaceutical industry. To kick off the debate, panellists commented on the trend or innovation they considered to be the most influential in 2019.

For Jeremy Drummond, Senior VP of Business Development, MedPharm, a key trend in 2019 was the increased interest in generic companies looking to penetrate the market for topical products.

Following the FDA and EMA guidelines that support the use of in vitro models to demonstrate bioequivalence, he feels that this is a movement that has been building for some time.

“Generic companies are appreciating that using these models reduces both the risk and cost of development. They are also discovering that regulatory authorities on both sides of the Atlantic are open to justifying these streamlined development programmes based on sound scientific arguments supported by robust data and solid scientific arguments,” he said.

“Another major trend has been the explosion of interest in the potential indications for cannabinoid derivatives. With the increased deregulation, investors want quick screens to point them towards the best target indication for this diverse range of products. Sophisticated in vitro models that can give pharmacodynamic, as well as pharmacokinetic readouts, are increasingly in demand,” he added.

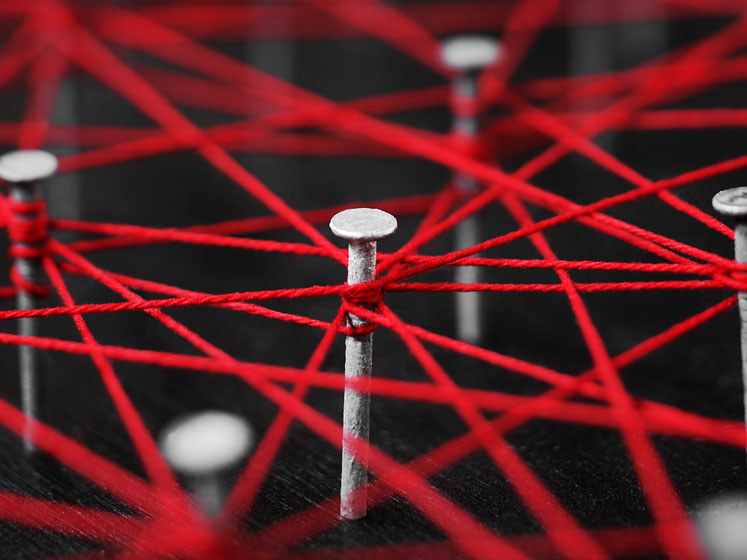

Andrew Henderson, Sales and Marketing Director, Sterling, notes that 2019 has seen the global contract development and manufacturing organisation (CDMO) sector partake in significant merger and acquisition (M&A) activity, with companies increasingly investigating ways to grow or consolidate their offerings.

“Companies that can offer multiple services are now at a greater logistical advantage in a highly competitive sector,” he commented, “as sponsors often try to avoid having multiple companies in their product supply chains. Fewer layers of complexity help to reduce project management requirements and can lessen a product’s time to market while lowering costs for the sponsor company. Naturally, we’ve seen a rise in global M&A activity in the CDMO sector during the past year in response to these requirements, which will likely continue throughout 2020.”

Sterling has also contributed to this trend. In April 2019, the company acquired a cGMP facility from CiVentiChem in Cary (North Carolina, US). The new facility gives the organisation a local presence in the US market, which makes up 70% of its global customer base, and helps to meet the growing demand for small-scale API development and manufacturing capabilities.

“One of the most influential developments in the industry in 2019 was the EU Falsified Medicines Directive (FMD), which came into effect in February. The serialisation requirements associated with the regulation brought about significant changes for companies in the pharmaceutical supply chain,” observed Marcelo Cruz, Head of Marketing and Business Development, Tjoapack.

Under the FMD, medicines must be correctly serialised and verifiable so that patient safety is not compromised by counterfeit products. The legislation requires all pharmaceutical products distributed in the EU to be fitted with a barcode containing a unique identifier (UI); products must also have a product code, batch number and expiry date.

This information must be uploaded to a supranational system to allow the product ID to be verified at the point of sale, which helps to ensure the product’s authenticity throughout the chain.

“Now that the deadline has passed, many companies have started to refine their operations in response to these requirements, with firms looking towards full aggregation as the next step. This is likely to provide additional benefits to supply chain partners and their operations,” he added.

Serialisation

Allan Bowyer, Director of Industry Marketing at TraceLink, stated that it’s “impossible to talk about 2019 without mentioning the serialisation regulations that have forced significant developments and opened the door for further innovation in the management of the pharma supply chain.”

The EU Falsified Medicines Directive (FMD) came into force in February and its rollout wasn’t a simple “find solution-implement-comply” transition. A number of countries implemented post-deadline stabilisation periods to help ease the transition and prevent medicine shortages — and with good reason.

“The success of FMD depends on pharmacists being able to scan and verify every serialised product … but a significant number of dispensers in Europe are still non-compliant, with France and the UK among those having the highest rates of missed connectivity. Broadly speaking, regulators in each country gave dispensers leeway to dispense packs when they were confident that an alert was false. Some country authorities have now ended their stabilisation periods, whereas others are beginning to wind down, with most expecting full compliance by February 2020.”

He continued: “Data integrity issues have also thrown out some notable challenges in various ways throughout the year. When solutions first went live, handling falsified medicine alerts was a significant concern for manufacturers and dispensers, with users saying they had not anticipated having to deal with so many alerts so soon. Fortunately, most of these were caused by data entry problems rather than intentional wrongdoing; this has been somewhat resolved with time, but the frequency of these alerts is still much higher than expected.”

There has also been a notable increase in the number of false alerts occurring owing to errors made by dispensers, mostly caused by misconfigured scanners and double scanning/decommissioning. These are still false alerts and the EMVO has tasked manufacturers with identifying the root causes of alerts and working to reduce the alert rate from its current amount (2.87%) to less than 0.05%. This will be an ongoing effort that’s likely to continue for months to come.

Russia calling

Talking geographically, Allan also reflected on the huge uplift in engagement from current customers in Russia, as well as a number of new partners that operate in the region in mid-2019. He said: “The serialisation and reporting requirements for Russia are considered to be the most complex in the world. As of 1 January 2020, all medicine imported into and traded within Russia must comply … and this applies to more than 370 manufacturers.”

The shortness of the deadline and lateness of clarifications when it came to the requirements of the law and technical guidelines (which continue to evolve), combined with the incredible complexity, has put serious pressure on businesses operating in the country; some, albeit late to the game, have not yet started implementation.

“For those that haven’t, it is imperative to choose a compliance solution, start implementing it now and start training personnel on the new system and business processes as soon as possible after that,” he advised.

Adding to the discussion, Mark Quick, Executive VP, Corporate Development at Recipharm, commented: “As the industry looks to diversify its capabilities and expand its geographical reach, 2019 saw a rise in consolidation amongst CDMOs and smaller pharmaceutical companies. M&A strategies have been vital to the success of CDMOs and their service offerings.”

“In this way,” he continued, “CDMOs have gained access to new technologies and specialised equipment that has enabled them to facilitate the delivery of offerings outside their core capabilities. This, in turn, bolsters their capacity to meet customer demand. To this end, consolidation has played a major role in CDMO activity and an increase in the outsourcing of development and manufacturing services."

Quick pointed out as an example that Recipharm acquired Sanofi’s former inhalation product manufacturing facility at Holmes Chapel (UK) in 2018. "This acquisition of this site has equipped us with access to specialist technologies for metered-dose inhalers and nasal sprays, as well as dry powder and other processes for the development and manufacture of inhalation products,” he said.

Manuel Leal, Director of Business Development at Idifarma, concurred. He said: “For us, demand for specialist manufacturing capabilities and the rise of smaller batch sizes to accommodate the growth in drug development for smaller patient populations and novel drug therapies has been a key driver. As more than 40% of the new chemical entities (NCEs) entering the drug pipeline have low water solubility, finding an effective strategy to improve poor bioavailability became even more vital in 2019.”

“As such,” he explained, “pioneering processes such as spray drying dominated discussions throughout the industry. Companies that had already invested in equipment to support complex drug development provided a unique solution to one of the industry’s most pressing challenges."

As drug requirements became more niche, the need for small batch runs and flexibility in manufacturing processes continued to be a prominent focus for the year. Because of this, we have seen further specialisation across the CDMO market as companies look to outsource their products to a variety of CDMOs depending on their requirements.”

Cannabis and containment

Barbara Morgan, General Manager at Lubrizol Life Sciences Health, explained: “In 2019, we broadened our Drug Enforcement Administration (DEA) registration to become an authorised manufacturer of Schedule I substances, including the analytical testing, development and manufacturing of cannabis-derived materials to be used in pharmaceutical applications for medically justified, legal uses in the United States."

For Morgan, there’s a lot of opportunity for further research into this active ingredient and we expect this area of investigation to increase. "The global medical cannabis market is projected to grow at a compound annual growth rate (CAGR) of 24.4% and surpass $20.17 billion by 2025, according to Coherent Market Insights," she explained.

Also relating to active ingredients, Christian Dunne, Global Head of Sterile Solutions at ChargePoint Technology, added: “From ensuring operator safety to protecting drugs from cross-contamination, the need for more innovative containment strategies continued to be a key focus for 2019 and beyond."

For Dunne, coupled with increasing demand for drug production using high potency active pharmaceutical ingredients (HPAPIs) and sterile manufacturing requirements, suppliers were faced with containment challenges across the pharmaceutical and biopharmaceutical industries. "Current technologies such as isolators and RABS offer substantial benefits to manufacturers, but advances in the industry have seen companies looking to develop their containment strategies to remain competitive and ensure compliance.”

Bringing the discussion to a close, Sascha Sonnenberg, Global Head of Business Development at Sharp Clinical Services, reminded us that patient centricity is, for sure, the biggest trend in the industry. “Having a well-defined strategy in this area will ensure that patients are recruited and stay engaged in a compliant and adherent way in clinical trials, he said.

Sonnenberg said that first and foremost, for pharma companies and sponsors, patient-centric trials practices will help them to make savings; faster recruitment and lower drop-out rates will shorten trials and deliver earlier revenue streams. "There is also a groundswell of regulatory focus and support for patient-centricity —with the FDA showing a particularly keen interest in understanding how this model can help to bring therapies to patients more quickly and efficiently," he concluded.