The completed analysis, performed by GlobalData, a data and analytics company, reveals a number of interesting insights.

The pharma sector’s 2017 v 2016 year on year performance inevitably created a mixed picture, with only half of the top 25 companies’ market cap achieving double digit growth and five players, Merck US, Celgene, GlaxoSmithKline, Allergan and Shire seeing their market cap fall.

However, based on market cap J&J, Roche and Pfizer retained market position among the top three players.

GlobalData’s analysis of each business in the top 25 is based on a number of key metrics including market cap (M Cap), price-earnings ratio (P/E), earnings per share (EPS), enterprise value to earnings before interest, taxes, depreciation and amortisation (EV/EBITDA), return on capital employed (RoCE %), return on assets (ROA), research and development as a percentage of sales (R&D/Sales %) and operating margin, to help assess the health of the top players.

Other highlights from the top 25 included Vertex, who fared better than most by doubling its market cap to $40 billion in 2017, driven by positive results from its clinical studies of a breakthrough drug for the treatment of cystic fibrosis.

Abbott and AbbVie also increased market cap by more than 50% in 2017, supported by their promising late-stage clinical pipeline. Novo Nordisk and Bayer entered the top 10 this year after crossing the $1bn market cap value, primarily driven by rising sales.

Amal George, Lead Analyst at GlobalData, said: "Novo Nordisk grew sales from the diabetes and obesity care categories through its Tresiba, Victoza and Saxenda brands, while Bayer benefited from the deconsolidation of its adhesive manufacturing subsidiary Covestro and increased sales from its core pharma brands Xarelto, Eylea, Mirena and Xofigo."

Notably Pfizer and Roche boosted their cancer drug lineup with $14bn Medivation deal and $1.7bn Ignyta deal, respectively, while J&J performed well in the pharma sector with a number of acquisitions including Actelion for $30bn.

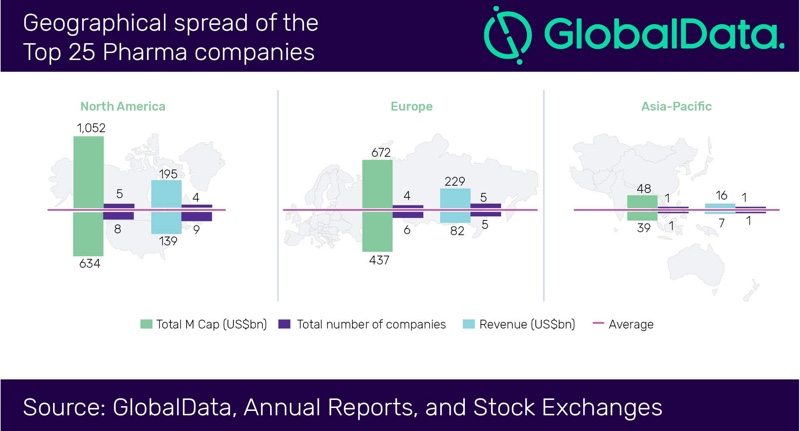

Geographical Spread of the Top 25 Pharma Companies

George added: "It is easy to see why investors have confidence in the sector. Collectively the top 25 pharma companies reported a healthy average operating margin of 22%, which increased to 25% for the top 10."

The average enterprise value for the Top 25 reached 24.9, while the average P/E ratio stood at 34.7 (excluding Vertex and Allergan). The average EPS for the group was positive at $4.5 (excluding Vertex and Allergan which had negative EPS), with Pfizer reaching an EPS of $1.2.

The top 25 achieved an average ROA of 9% and RoCE of 16.2%, with 14 companies recording double digit RoCE, including Novo Nordisk’s exceptional 96.7%.

The top companies continued to invest in R&D, with an overall R&D/ Sales average of 18.2% (excluding Vertex 96.5%). These players were also active in acquisitions and developing partnerships, examples being J&J’s collaboration with Schering-Plough, Mitsubishi Tanabe Pharma, GlaxoSmithKline, Alkermes, Vertex, and Bayer and Pfizer’s partnership with Celltrion, Merck and Astellas Pharma.