Manufacturers face significant challenges in managing their supply chain. Cognizant offers its view of the capabilities required and how to achieve them cost-effectively.

As pharmaceutical and medical device companies respond to significant changes in the industry’s fundamentals, the implications for the supply chain are far-reaching. Historically, the goal for the supply chain was easy to state: ensure Good Manufacturing Practice (GMP) compliant supply of medicines. However, margin pressures and an increasingly complex product portfolio now require supply chain leaders to optimise their operations for a more complex set of goals, such as:

- To create a more agile supply chain, which is responsive to the needs of new, more complex products and to changes driven by alliances, mergers and acquisitions

- To reduce the supply chain asset base: externalise operations and rationalise internal capacity

- To reduce working capital: drive down end-to-end inventory

- To reduce total cost of goods sold (COGS): optimise operations over the product life cycle.

Industry players have responded to these opportunities pragmatically by increasing the level of outsourcing, optimising processes and through closer working with development and commercial departments. Consequently the ability to collaborate effectively across traditional boundaries is core to the operation of the new industry supply chain.

Optimising the total performance of this supply chain relative to the operational goals stated above is a significant industry opportunity. Success is dependent on achieving end-to-end visibility and on effective management and control. Information Technology (IT) is essential to enabling this visibility, collaboration and control; however IT solutions have struggled to keep pace with the changing demands of the industry and are often seen as a barrier to rather than an enabler of change.

IT has developed new technologies, platforms and service models that have the potential to build the capabilities in an organisation and enable it to manage the shift in focus within the extended supply chain. The key capabilities that matter are:

- Integrated Plant Operations Platform; synchronising operations to reduce inventory and labour

- Supply Chain illumination; to provide fundamental performance information and to track product

- Global Compliance Shop; to reduce the cost of compliance

- Virtual Supply Chain Collaborative Environment; to optimise end-to-end system performance.

Integrated plant operations platform: Manufacturing Plant Operations is the key functional subset in the supply chain. Therefore integrating plant operations and the key elements associated with it becomes the prime function to support the future supply chain. Pharmaceutical manufacturing organisations have lagged behind on multiple fronts when compared with any world class manufacturing organisation.

| Table 1: Scope for improvements in the pharma supply chain | |||

| Key performance indicators | |||

| Stock turn | |||

| OTIF | |||

| OEE | |||

| Cycle time (Hrs) | |||

NB. Stock turn is a measure of how fast a business turns over stock. OTIF is on time in full, a measure of the capability of the process to produce product when required. OEE is overall equipment effectiveness, the percentage of time for which process equipment is adding value.

Source: R. S. Benson and D. J. MacCabe. Pharmaceutical Engineering, July/August 2004

Pharmaceutical manufacturing organisations have deployed multiple systems and solutions within and above their plants to try and improve their performance in some key areas, but the desired outcome was not achieved. Vertically, various layers within plant operations need to be connected to get a near real-time picture of the plant Key Performance Indicators (KPIs).

Additionally, connecting them to the peripheral support systems such as Building Management and Material Movement Systems would enhance agility in operations. A direct impact of this would be process efficiency improvement and lower inventory levels on the shop-floor.

The need for a fully integrated manufacturing plant is very compelling. However, implementation and integration of these systems is still not mature across the industry. The benefits of an Integrated Plant Operation Platform range from end-to-end synchronisation, process optimisation, better capacity planning, manufacturing intelligence for decision support, cycle time reduction to throughput improvement.

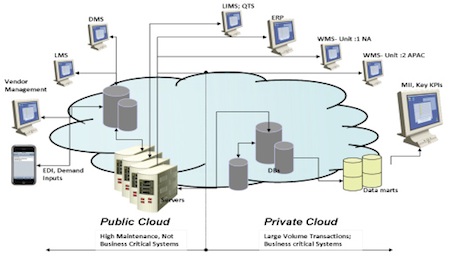

Figure 1 depicts a layered architecture of an integrated platform. Real-time plant data captured is integrated with Manufacturing Execution System/Manufacturing Integration and Intelligence (MES/MII) and analytics, which in turn are integrated with the core systems, such as Enterprise Resource Planning (ERP) and Laboratory Information Management Systems (LIMS).

Supply chain illumination: Historically, the pharmaceutical industry has been a ‘push’ market with minimal view of consumer demand, frequent stock outs and low perfect order performance. But today, pharmaceutical manufacturers face significant challenges to operate their supply chain.

The fundamental changes within the industry and ever-changing needs of their customers have given rise to multiple demands from supply chain leaders related to visibility of their product and associated data, the need to optimise their inventory, capability to deal with chargeback and rebates, the need to control shrink and map material plan to existing capacity, improve demand plans, increase accuracy of forecasts and control their costs.

The industry experiences losses due to sub-optimal channel management and inefficient reconciliation process (rebates, chargeback etc). Wholesalers and retailers’ capability to provide product and associated data visibility to the manufacturers is a critical success factor for an optimised supply chain, but only a small percentage of them have the capability to do it. Effective collaboration between supply chain partners has the potential to reduce inventory, increase sales and increase availability of stock of the right product.

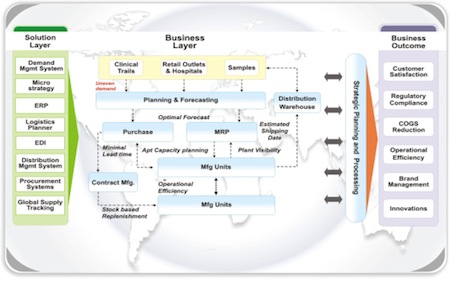

Figure 2 provides a high level view of the supply chain process and of various IT enablers that have the potential to enable supply chain illumination at the product and data level.

Fig. 2: A supply chain overview with various IT enablers that have potential to illuminate supply data

Global Compliance Shop: The pharma industry has been monitored and controlled across the whole drug development and commercialisation lifecycle for many years, catalysed largely by increased scrutiny due to defective products.

The industry as a whole has seen a spike in the cost of compliance with respect to internal quality systems, and new systems and processes to control product integrity in the external supply chain (around 25% of the total site operating budget). Compliance-related IT spend, more complex supply chains and country specific regulations have increased challenges and costs.

Harmonisation of compliance processes and procedures, optimisation of regional and site-specific applications, leveraging a shared service model for compliance using geographical time advantage and deploying virtual solutions to enable global compliance are some of the best practices that can be adopted in the future to reduce the total cost of compliance and thereby have a positive impact on the costs associated with the extended supply chain.

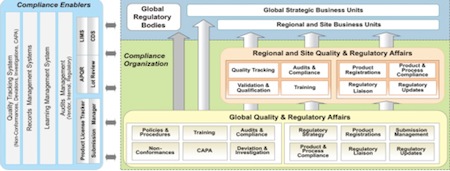

Fig. 3: The building blocks of a global compliance organisation

Virtual Supply Chain Collaborative Environment: Figure 3 showcases the building blocks of a global compliance organisation. The illustration depicts, at a very high level:

- How a collaborative supply chain function exists in the real world

- The different ideas/solution themes which can be the building blocks for a collaborative supply chain specific to pharma organisations

- Significance of Cloud and related technologies to realise a collaborative supply.

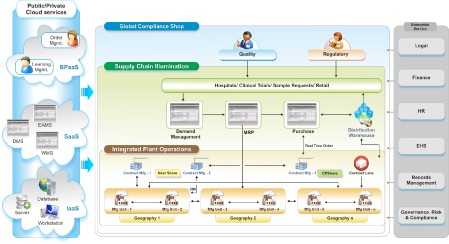

Fig. 4: Virtual Supply Chain Collaborative Environment

Supply chain business processes are good candidates to be managed as outcomes-based services. With goals of transparency and cost-efficiency in mind, outsourcing can be a useful lever to reduce cost and improve control. Increasing numbers of applications can be provided as a service with the right combination of technology and knowledge, from reporting and trade management to digital rights management and business analytics.

As business processes and their supporting applications vary in design, intent and outcome across the pharmaceutical industry, a virtual environment can be built across a private platform, public platform or a combination incorporating components of Software as a Service (SaaS), Infrastructure-as-a-Service (IaaS) and Business Process-as-a-Service.

A virtual collaborative platform provides a pharmaceutical organisation with the capability to reduce its operational costs and retain control over the quality and integrity of its products. It also offers flexibility and performance to manage supply chain reconfiguration, new geography penetration and maintaining a regular pipeline for existing products.

Fig. 5: A virtual environment with SaaS, IaaS and Business Process-as-a-Service

Often the cost of implementing a supply chain visibility solution is so high that it is not a viable option, but a virtual collaborative platform can bring the cost down significantly, as well as increasing the choice of services. It has the potential to improve the ability of a pharmaceutical business to manage a complex collaborative network that can ensure supply of a quality product, while enabling the pharma company to provide the Right Patient with the Right Drug of the Right Dose at the Right Time through the Right Route.

Technology enabled collaborative convergence, in the long run, is bound to provide greater control and insight into how every player in the value chain affects the supply and demand side of healthcare economics. This will ensure that the five ‘Rights’ of medication safety are achieved and the benefits eventually passed on to the healthcare consumer.

As the performance of the supply chain becomes increasingly dependent on effective integration and collaboration, each player in the network has to consider how to build the capabilities it needs. This raises an interesting question: ‘Does it make sense for each company to determine its own solution or could a utility- or standards-based approach deliver a better solution at lower cost?’