The first six months of 2019 have seen bulk transactions valued almost US$140 million offered through its network and platform. Besides a convenient exchange of raw materials, it also offers exclusive market insights such as index prices for selected vitamins and APIs.

Safe and convenient solution for professional purchasers, traders and manufacturers

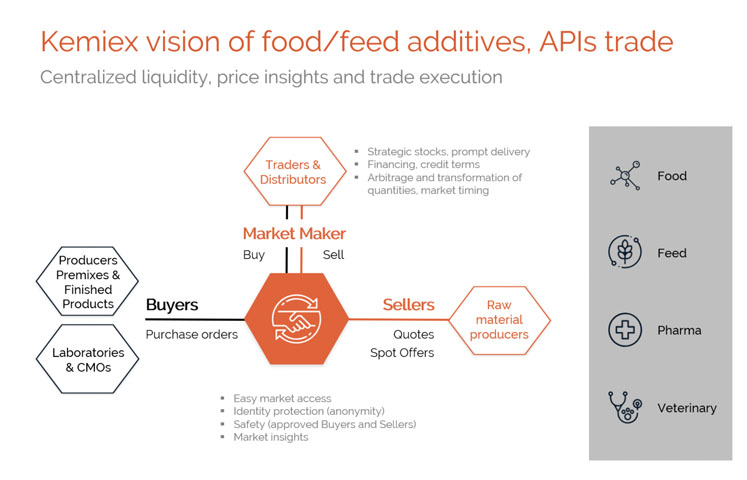

Established in Switzerland in 2017 after three years of development, KEMIEX aims to substantially improve the way vitamins, bulk active pharmaceutical ingredients (APIs) and other food & feed additives are traded in the industries of nutrition and health for humans and animals.

Such products, among others, include aminoacids, minerals, sweeteners, flavours, preservatives and APIs such as antibiotics or antiparasitics.

The team consists of commodity and electronic trading experts who are advised by seasoned life sciences professionals. The network and platform is not comparable with traditional e-commerce solutions such as Alibaba or search engines to find suppliers.

Moreover, it is only accessible to purchasers, traders and manufacturers that meet predefined quality assurance and financial health criteria and show good trading behaviour on the platform.

Market structure changes seen in other industries

KEMIEX is innovating raw material purchasing and trade based on best practises from commodities and financial product trading. These markets have experienced major shifts from direct, over-the-counter (OTC) to centralised exchange trading. First a move to physical trading floors, then to specialised electronic trading venues.

In 2007, the leading global marketplace for commodities, the CME Group, emerged from the Chicago Mercantile Exchange founded 1898, and the Chicago Board of Trade (CBOT) founded 1848. The new group is a leader in global agricultural raw materials, such as soft commodities and livestock, as well as energy and metals.

Other examples include trading venues for currencies such as Deutsche Börse’s 360T and Refinitiv’s FXall, formerly Thomson Reuters. While currencies already moved to centralised trading in the 1990s, first electronic fixed income marketplaces were established only in the 2010s, such as ICE Intercontinental Exchange’s BondPoint.

Benefits of centralised trade

Purchasers benefit from higher product availability and liquidity, convenience through a single-point-of-entry, identity protection, as well as fair market prices, market insights and efficient trade execution.

Traders increase their revenues and market reach by selling raw materials to end users efficiently, offering prompt delivery from their strategic warehouses and flexible financing terms. In many market situations, traders offer better products and prices than producers as they bought large quantities at economies of scale or during faorable market cycles.

In special situations, traders will also buy raw materials from other traders, previously mostly handled by traditional voice brokers at high and opaque margins.

For manufacturers, it is an efficient and new distribution channel to offer future deliveries to end customers worldwide.

A novelty for this industry: market and price insights

In June, KEMIEX started publishing indexed pricing for selected vitamins, such as vitamin C and B5, also known as calcium pantothenate, as well as for APIs such as amoxicillin, doxycycline, fenbendazole and oxytetracyclines. Such strategic pricing information is a novelty to these industries and adds to private information of each market player.

For instance, vitamin C has experienced skyrocketing prices and volatility in 2017 and 2018 leading to increased purchases during 2018. By late 2018, the market appeared overstocked and consequently market price has fallen below production price in China which is estimated at around US$3.00.

It is now recovering to more sustainable levels but at the same time, professionals were speculating at CPhI Shanghai in June that additional capacity from reputable providers will enter the market this year still.

Strategic partnership with trade credit insurance provider Atradius

Atradius, a global leader in trade credit insurance, formed a unique strategic partnership with KEMIEX in 2018. Atradius provides credit risk insight and insures trade between sellers and buyers. Atradius clients are directly connected to their annual whole turnover insurance policies, replacing the need to contact underwriters before and after a transaction.

For non-Atradius clients and for the first time in credit insurance history, single transactions can be covered in selected European markets through an innovative new product.

Pau Franquet, CEO, KEMIEX, commented: “The introduction of a neutral commodity exchange platform marks a quantum leap for these industries as currently many participants are facing issues to identify reliable and compliant products and counterparties."

"Closing a transaction often involves managing a flood of emails and calls to request quotes and handle the trade process and, because of limited public information available, it remains a challenge to achieve best market access and terms.”