Price is the single most powerful lever to increase a company’s profits. So why are so many companies still holding onto the one-size-fits-all traditional cost-plus pricing logic?

As many pharmaceutical and biotech companies strategically outsource their product development and manufacturing, this article advises CDMOS on how to capitalise on the trend through effective monetisation. Key to success is intuitive offer design and a value-based pricing approach.

With an estimated worth of $1.5 trillion in 2021, the pharmaceutical industry is on a continuous growth course. This is positive news for CDMOs, who are likely to benefit from the accelerating trend toward outsourced product development and manufacturing.

However, the path to success will not necessarily be a smooth one. There are also significant commercial hurdles to overcome in this consolidating market, in which many CDMOs struggle to tap into and monetise their customers’ true willingness to pay.

A general lack of price control — as well as complex, opaque offerings — mean money is frequently left on the table. For CDMOs to fully unlock their true potential, the right approach to project pricing, value-based metrics and a structured use of defined offer packages will be crucial.

Let’s start by looking at how pricing is commonly approached by many CDMOs today. In our projects, we typically encounter several pricing issues:

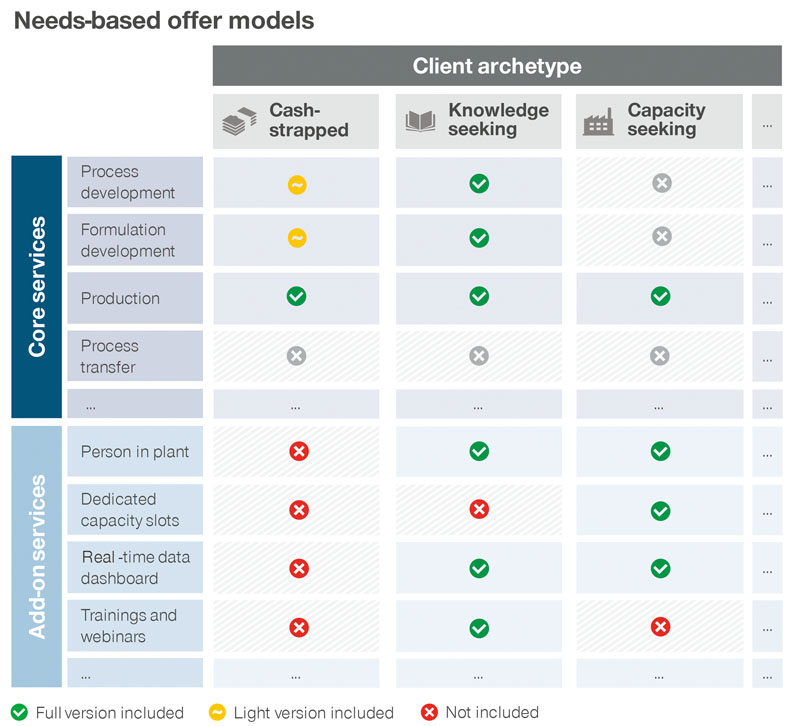

Limited and unstructured offer design: When pharma companies approach CDMOs, they are usually presented with one of two choices: either the completely standardised option, which doesn’t fully cater to their needs, or a highly bespoke project with countless variables.

Neither is satisfactory in terms of differentiation and maximising willingness to pay. Without a tiered logic, there is little room for, up- and cross-selling because customers are forced to choose between the most basic of activities or full customisation.

Adding a wider, more carefully thought-out selection of activities to the portfolio offering would allow customers to gradually increase scope and service levels as their needs develop … and capture a wider range of willingness to pay and ultimately pricing.

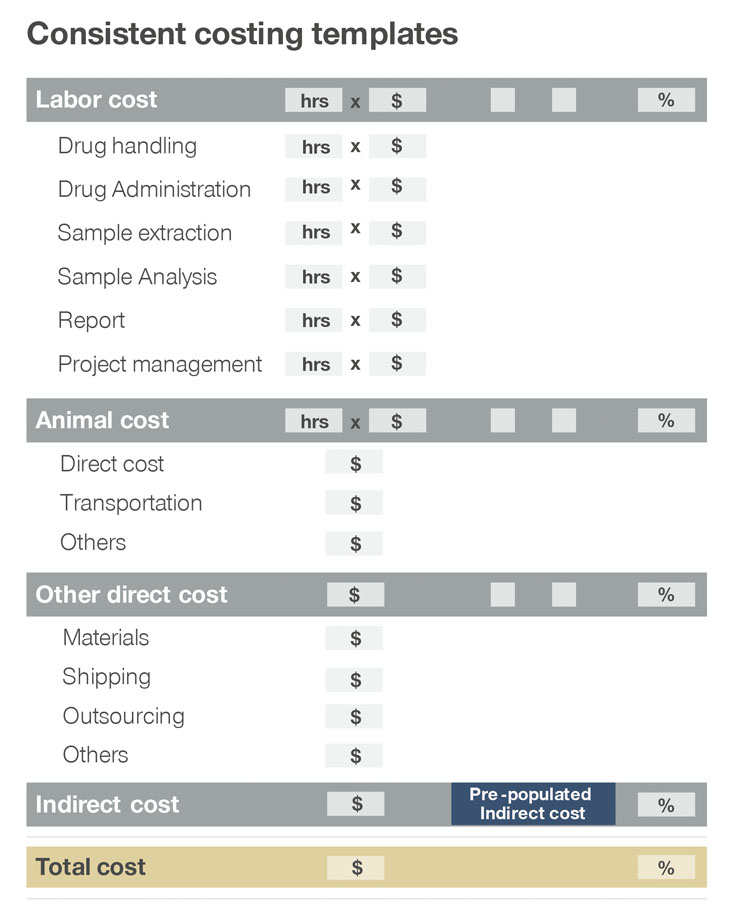

Costing black box: Owing to the frequently high level of customisation, many CDMOs argue that no project is the same … and costs are linked to a variety of variable factors that cannot be standardised and require bottom-up calculation.

To ensure the company operates profitably, it is crucial to determine the full costing in advance. Here, it is common for managing directors of individual sites to manage their own profit and loss statements and determine the project scoping and costing as they see fit.

As a result, cost calculation and reporting frequently depends on site-specific preferences and legacy, creating a black box project costing for headquarters/central pricing roles that should be consistent and standardised.

Lack of value-based pricing: Rather than systematically differentiating project margins based on client value, anticipated risk profile or strategic dimensions, we often find that pricing is cost-plus, short-term and silo-focused.

CDMOs usually apply a standard site-specific mark-up on their costing without factoring in the value of individual services, following a one-size-fits all approach.

And although some services might be standard, others are unique … and this should be reflected in a differentiated or higher mark-up. At the same time, client-specific risk and value drivers that drive client cost-to-serve and willingness to pay are only captured opportunistically without a consistent logic.

Three ways to tackle pricing like CDMO pros

Although there are clearly some significant pricing hurdles to overcome, our experience from numerous projects in the industry shows that it is possible to grow sustainability through innovative monetisation strategies. Here is what separates the best-in-class CDMOs from the rest.

Combine local cost levels with a consistent, globally aligned logic: Although site managers need to be given room to make their own decisions, these also need to be in line with a company wide costing logic and supported by a specific framework.

Best-in-class companies have standardised project costing, including guidelines, tools and processes. To achieve this level of granularity, start by having every site conduct a realistic cost assessment based on a consistent guiding principle, then aim to strike a common balance with the different project sites.

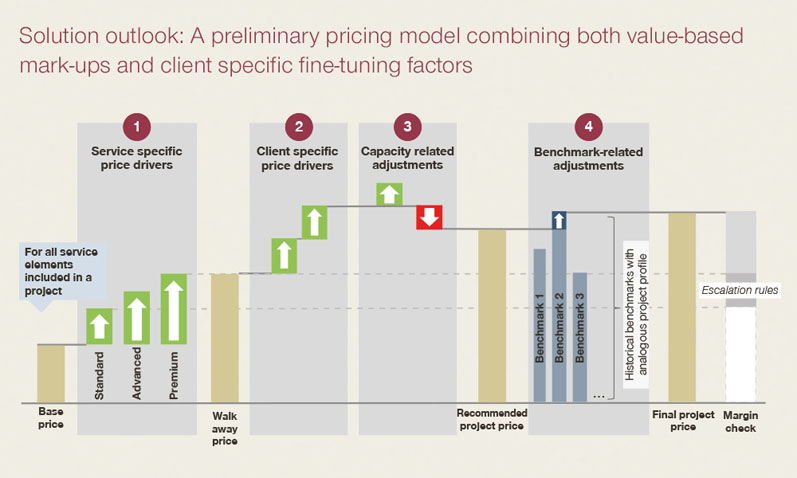

Determine project-specific value drivers to tap into willingness to pay: Value-based pricing means understanding all of the relevant value and price drivers, but reliable data input to determine this is often hard to attain — especially as projects are unique and the pharmaceutical industry is relatively opaque with limited access to detailed customer decision-making processes.

Therefore, you will likely need to make sound hypotheses based on internal expert judgement, past behaviour and accessible data.

Start with identifying the drug potential, client time pressure, reliability risk, commercial potential and site capacity, and then translate these value drivers into quantifiable margin mark-ups or -downs.

Combine this with categorising services by the level of differentiation compared with the competition and add to this historical price benchmarks based on similar deals.

This will allow you to curtail gut-feeling assessments and keep price variations between similar contracts and customers to a minimum or alternatively ensure that you differentiate price across different types of contracts and customers and maximise price potential.

Design a “good, better, best” offering that provides room to manoeuvre in negotiations: The optimal offering design has two prerequisites: first, you need to detail the existing activities within the core offering to fully understand which activities are must-haves and which are optional, enabling you to define concrete offer packages.

The second is to map and define value-added services that can be added to enhance the customer experience and knowledge transfer, such as a virtual person-in-plant and performance benchmarking.

With these two requirements fulfilled, feature and price enforcement can then be identified. If during negotiations a customer demands a lower price, you should simply offer them a lower service quality/tier.

In doing so, the customer achieves the desired outcome (a lower price point) while, at the same time, you protect the profitability of your service by lowering the scope and avoiding immediate discounting.

Stripping your offer of these additional services is easier and more profitable than changing the core development/manufacturing scope of the project. Always scope down the offer first rather than reducing the price!

Pricing processes, systems and tools are key for implementation

Successfully tackling pricing like the CDMO pros is only possible by having the right processes, systems and tools in place. Here, we recommend developing a pricing tool that is easy to use and supports quotes through harmonised costing methodologies.

Based on both value-based pricing methods and newly defined benchmarks, this kind of customised pricing tool enables CDMOs to configure and price projects in a structured manner … and makes it possible to consistently identify potential up-sell opportunities with defined packages.

Combined with a systematic project pricing logic based on value-based mark-ups/downs, pricing tools considerably enhance the ability of CDMOs to tap into customer willingness to pay and negotiate optimal prices.

Final thoughts

When CDMOs follow a consistent approach to pricing, supported by clever offer design and a value-based pricing metric, the reward can be substantial.

In our experience, CDMOs are typically able to boost their margin and profitability by 3–6% return on sales and, at the same time, increase customer satisfaction by offering them what they need for the right price and differentiating from the competition.