Piramal Pharma has announced its consolidated results for the third quarter (Q3) and nine month (9M) ended 31th December 2022.

Key Highlights for Q3 FY23 and 9M FY23

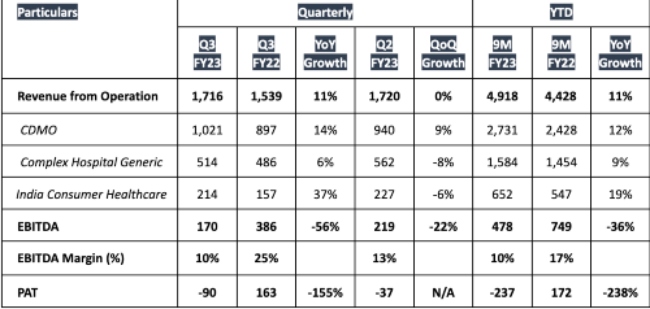

- Revenue from Operation grew by 11% YoY in Q3 FY23 and 9M FY23.

- EBITDA margin for Q3 FY23 and 9M FY23 was 10% - impacted by higher operating expenses including raw material cost, energy prices wage inflation and marketing cost.

- Successfully cleared 29 regulatory inspections (including US FDA) and 155 customer audits in 9M FY23.

- New capabilities / capacity expansion gone live at Ahmedabad PDS, peptide facility (Turbhe, India) and Riverview (US).

Nandini Piramal, Chairperson, Piramal Pharma said: “Basis our recent increase in customer engagements and continued inflows of RFPs (Request for Proposals), we believe that the demand for CDMO services, especially for our differentiated offerings remain strong. We continue to maintain our quality track record with successful US FDA inspection at our Riverview facility."

Piramal continued: "In our Complex Hospital Generic business, the Inhalation Anesthesia portfolio is seeing a healthy demand. Further, our India Consumer Healthcare business is delivering growth driven by power brands. Investment in e-commerce channels is also yielding good results.

We believe in the potential of our business and in-line with our aim to grow, the Board has approved the recommendation to allot equity shares for an amount not exceeding INR 1,050 Cr., subject to receipt of requisite regulatory approvals, market conditions and other considerations.”

Contract Development and Manufacturing Organisation (CDMO):

- Maintaining our quality track record – successfully cleared 29 regulatory inspections (including US FDA) and 155 customer audits in 9M FY23.

- US FDA inspection at Riverview, Sellersville and Lexington facilities in the US: Zero observations at Riverview.

- Form 483 with VAI* classification at Sellersville and Lexington.

- Continued slower decision making by customers due to macro-economic environment and increased focus on pipeline prioritisation.

- Undertaking judicious price increases, cost optimisation and operational excellence measures to offset inflationary pressures.

- Planned growth CAPEX is on track.

- New capability / capacity expansion going live.

- Ahmedabad PDS site (new In-Vitro Lab), significant capacity enhancement at peptide facility at Turbhe (India) and capacity expansion at Riverview facility (US).

Complex Hospital Generics (CHG):

- Continued momentum in Inhalation Anesthesia (IA) sales in the US with volume growth driving market share gains.

- Adding IA capacities in India to serve the growing demand from non-US markets.

- Intrathecal portfolio in the US continued to command leading market share "Injectable Pain Management".

- Growth in Q3FY23 and 9MFY23 impacted by supply constraints. Production has ramped up over last few months.

- Launched 2 new products during Q3FY23.

- Building pipeline of new products which are various stages of development.

India Consumer Healthcare (ICH):

- 21 new products & 25 new SKUs launched during 9MFY23.

- New products launched in last 2 years now contribute to 17% of total ICH sales.

- Continue to invest in media and trade spends to drive growth in power brands.

- Power Brands – Littles, Lacto Calamine, Polycrol, Tetmosol and I-range, grew by 39% YoY in 9MFY23 and contribute to 41% of ICH sales.

- E-commerce grew by more than 50% YoY in 9MFY23.

- Wide distribution reach across 200,000 outlets and 12,000+ organised retail stores. Also presence across all leading e-commerce platforms.