Dr. Devendra Puntambekar, Head of Commercial and Business Development at Gaelic Laboratories, explains why pharmaceutical companies across the world are turning their gaze to the Middle East, as the region’s pharmaceutical market has been revealed as having one of the world’s fastest and largest annual growth rates.

Whilst the term ‘Middle East’ refers to extensive lands around the southern and eastern shores of the Mediterranean Sea, including some parts of North Africa, the majority of this region’s economic growth is generally credited to five countries: Saudi Arabia, the United Arab Emirates (UAE), Iran, Israel and Egypt. These countries have particularly strong economies underscoring critical investments and government initiatives to improve healthcare. New state of the art hospital complexes with advanced hi-tech equipment, along with plenty of well qualified staff and a shift towards more advanced treatments, cater to the increasing prospects of their citizens.

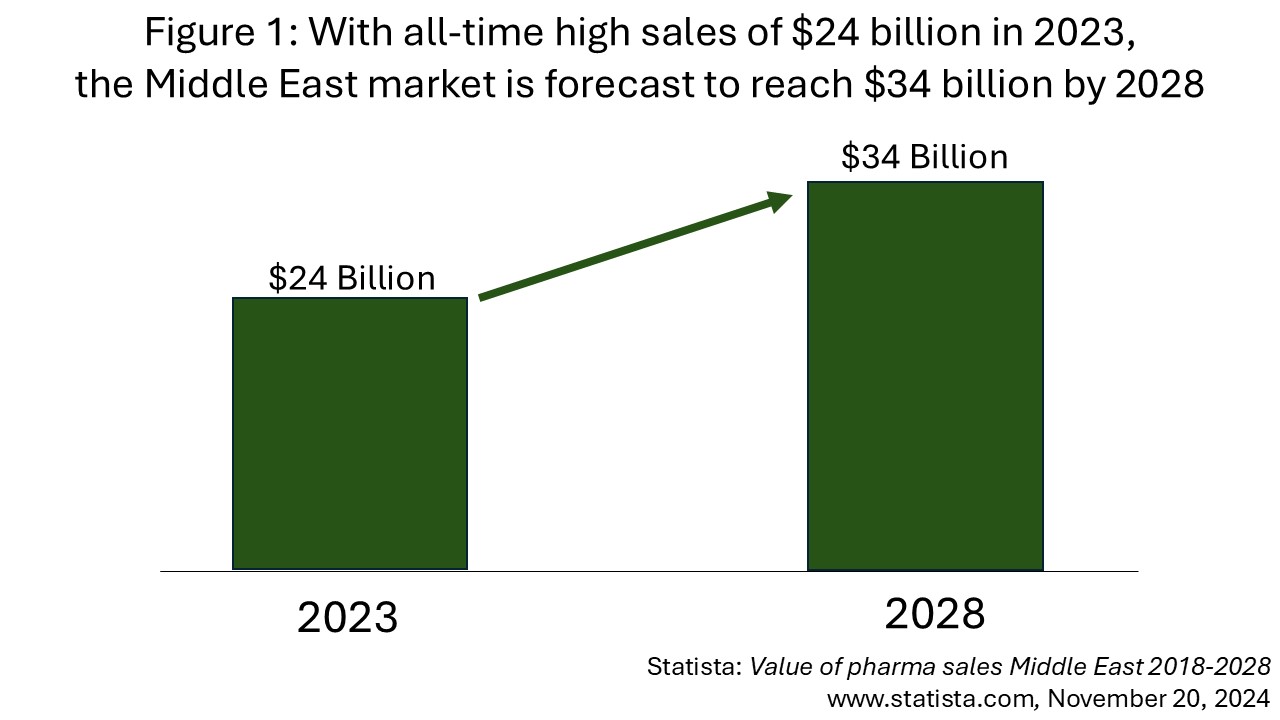

In fact, the overall Middle East pharmaceutical market is growing at around 10% per year, which is twice as fast as the global pharmaceutical market (Figure 1). This makes the Middle East a highly lucrative market, and a highly desirable destination for pharmaceutical companies all over the world.

Regulatory revolution

Concurrent with the market’s recent rapid growth, there has been a drive towards more robust regulatory frameworks to ensure the safety, efficacy and quality of pharmaceutical products. In fact, few regions have witnessed transformations as significant as those seen in the Middle East pharmaceutical industry over the past couple of years. The regulatory environment in this region has experienced profound changes in a remarkably short space of time.

Central to these changes has been a commitment to adopting globally recognised standards and practices mirroring those of the United States Food and Drug Administration (FDA) and the European Medicines Agency (EMA). The Middle East’s alignment with the FDA and EMA facilitates the registration and approval processes for new pharmaceutical products, and it enhances confidence among stakeholders in the entire value chain, including healthcare professionals and patients. The regulatory shift has also seen a move towards greater transparency and accountability as regulators increasingly emphasise the importance of ethical standards and regulatory compliance across the pharmaceutical supply chain.

The Middle East has also seen changes in pharmaceutical pricing, with a move towards ‘External Reference Pricing’ (ERP). Under this system, set prices are based on comparisons with prices of similar products in other countries. As with other regions using this type of pricing system, the ultimate goal is to control overall healthcare costs, but there is a concurrent focus on value-based pricing that considers clinical effectiveness alongside cost when evaluating new drugs. All this means that understanding the new pricing guidelines is another necessary consideration for any company wishing to market pharmaceutical products in this region.

Most recently, as of 2nd January 2025, the UAE enacted a so-called ‘New Law’, which is a significant update to the former regulatory framework. It aims to enhance the governance of medical products, the pharmacy profession and pharmaceutical establishments in the UAE, and it includes the following changes that are of potential relevance to companies intending to market products in the region.

- Expanded regulatory scope: the framework now regulates medical devices, biopharmaceuticals, food supplements and cosmetics as well as traditional medical and pharmaceutical products, and an extended range of establishments within its remit now covers pharmacies, laboratories, biobanks, manufacturing facilities, contract R&D companies, marketing offices, warehouses and storage facilities.

- Marketing approvals: new types of regulatory approval for products include conditional marketing approval for orphan drugs or treatments of rare diseases, emergency use authorisations, and a fast-track pathway for important innovative pharmaceutical products.

- New central authority: the Emirates Drug Establishment (EDE) replaces the Ministry of Health and Prevention (MOHAP) as the consolidating regulatory authority with the responsibility for overseeing medical approvals and pharmacovigilance.

- Enhanced pharmacovigilance: there are now stricter pharmacovigilance obligations, including monitoring and reporting adverse events. In fact, having a dedicated registered pharmacovigilance officer is a key requirement for establishments like marketing offices.

- Stricter penalties: the New Law sets out more severe disciplinary sanctions for companies failing to comply with regional requirements, including higher fines, imprisonment, suspensions and market bans for violations.

For companies wanting to access the lucrative Middle East market, these recent changes to the regulatory environment dictate that manufacturers (external/local within the region) and distributors must adapt to new marketing approval processes and ensure adherence to pharmacovigilance requirements under EDE oversight. While this requires some local expertise and investment in navigating the many-faceted evolving regulations, it could be considered a relatively straightforward paper-based requirement, compared with a key obstacle introduced under the so-called ‘New Pharmacy Law’ that came into play a couple of years ago.

The ‘New Pharmacy Law’

In 2023, the Middle East enacted a law governing medicinal products, pharmacy professions and pharmaceutical establishments. This law introduced new requirements for companies importing products into the Middle East. Under the New Pharmacy Law, the Marketing Authorisation Holder (MAH) must have (or must collaborate with) two or more pharmaceutical establishments that have been established and registered within the Middle East region, before they are permitted to import and market their products.

In order to import, register and distribute pharmaceutical products in the Middle East, a company must be established and registered with a local regulatory authority. A medical warehouse licence is also an essential requirement for importing, storing and distributing pharmaceuticals. The local distributor acts as a representative of the MAH, as reflected in the regulatory authority’s registration for each product being distributed.

Since its enactment, it has been recognised that this New Pharmacy Law might impact business plans, because it necessitates the presence of two companies for marketing, and one for importing and distribution. For companies without a physical footprint in the Middle East, this requirement presents a significant barrier to market entry, potentially depriving regional populations of important new pharmaceutical products and possibly limiting competition in the region.

Meanwhile, with its strategic location and burgeoning healthcare infrastructure, the UAE has emerged as a hub for pharmaceutical innovation. The country has spearheaded progressive policies to streamline regulatory processes and foster an environment for pharmaceutical companies to thrive. This makes the UAE an attractive location for companies looking to establish a base in the Middle East. Certainly, Gaelic Laboratories – a European CMO based in Ireland – chose the UAE as the location for its recent expansion into the region. By the end of 2024, Gaelic Laboratories had set up a Commercial Arm in the UAE, with sufficient pharmaceutical establishments to enable the company to import, register, market and distribute medicines in the Middle East, in compliance with the New Pharmacy Law.

While the Middle East presents a promising lucrative market for international pharmaceutical companies, distribution of products in this region requires careful compliance with applicable laws and regulations, particularly regarding the import, registration and distribution of pharmaceutical products. Numerous sources have advised companies to seek guidance and assistance before entering the Middle East market to avoid common (and expensive) mistakes, and to mitigate risks. Alternatively, companies interested in marketing their products in the region may choose to partner with a reputable company that has an existing footprint in the Middle East, and that has the infrastructure necessary to collaborate with other companies, such as your own, wanting to access this rapidly growing market.

Choosing a partner

By understanding the interconnectedness of the healthcare industry, aligning goals and maintaining open lines of communication, pharmaceutical companies and MAH partners can develop lasting, reliable partnerships. However, as with any formal business collaboration, it is important to choose your MAH partner carefully.

Among other qualities, you should be looking for transparency, accountability, ethical standards and regulatory compliance. In addition, if your own company is going to be associated with a MAH partner throughout the Middle East region, you will want to be sure that it has a good reputation for manufacturing and/or distributing high quality products. A clear understanding of regional regulations will also be a necessity.

It is important to consider the foundation of your relationship. For example, the MAH partner’s mission should align with your own, and the importance of understanding each other’s values should not be underestimated. Particularly important for the healthcare field, the right MAH partner should be collaborative, transparent and adaptable, with the ability to align their services to meet the needs of your company and your patients. Ultimately, the right partner should work collaboratively towards your organisation’s goals with you.

Your MAH partner should be able to monitor regulatory developments as well as anticipating supply and demand for your products. They should be prepared to respond quickly, especially in a rapidly evolving regulatory environment, to minimise any potential impact to your company. For this purpose, understanding regional and global regulations is clearly critical. For example, adding to the company’s regulatory expertise at its headquarters in Ireland (in the EU), the Gaelic Laboratories Drug Store and Scientific/Marketing Office in the UAE brings a full team of experts to manage access to the Middle East market, including regulatory consultants with a deep understanding of the requirements of local authorities. This in-depth level of expertise is vital for our own generic Beta Lactams business in the region, so it is already established and in place as an offering to our partners as well.

Conclusion

The Middle East market may be hard to navigate for companies without an established presence in the region. The situation is further complicated by a rapidly evolving regulatory landscape that requires constant vigilance to ensure compliance – now and in the future – with any new obligations. Mistakes can be very costly and, in order to avoid penalties, companies intending to enter the Middle East market might benefit from partnering with a company with an established infrastructure in the region, and with expert knowledge of local regulations.

With the opening of our Marketing/Scientific Office and Gaelic Drug Store LLC in the UAE, Gaelic Laboratories now has an infrastructure that enables it to market its own high-quality generic products in the region, and also allows us to partner with other companies wanting to access the Middle East market. An expert regulatory team staffs the Marketing/Scientific Office, while the Gaelic Drug Store LLC provides a temperature-controlled warehouse with sufficient capacity to manage imported products – all of which are verified by an in-house pharmacist – for regional distribution. Gaelic Laboratories is a European company with an excellent reputation for quality, transparency, ethical standards and regulatory compliance. We have been distributing our own generic products in the Middle East since 2024, and this year we are delighted to start partnering with other companies wanting to distribute their products in the region.

Approached correctly, the Middle East market offers good quality, reputable pharmaceutical companies the opportunity to reach many more patients who may benefit from their products. As more international companies gain access to this growing market, the hope is that we will all bring innovative, high quality, affordable products to patients across the region. The goal of good global healthcare, improving health for all people in all nations, is closer than ever before.