Despite being one of the most productive industries in the UK, pharmaceutical manufacturers are facing a number of key challenges, including responding to changing consumer demands.1

These consequences also impact the original equipment manufacturers (OEMs) that supply their machines. The sector requires that its OEMs manufacture systems with ever-shorter run times, greater flexibility and increased efficiency for their customers to stay competitive.2

Pharma 4.0 — which refers to the digitalised technology that can be applied to the pharmaceutical sector — brings clear and specific benefits to the industry.3 It introduces highly flexible and totally automated manufacturing that enables new economies of production and interoperability, and allows businesses to take a product to market more quickly by connecting the supply chain to the production facility.

Connected and communicating production machinery reduces wastage. This enables more flexible production with shorter changeover times, provides greater energy and machinery utilisation transparency and improves overall equipment effectiveness and other key performance factors.4

Pharmaceutical facilities typically experience high levels of downtime. According to one analyst, digitalisation and data analytics could reduce this by 30–40%, significantly improving overall equipment effectiveness (OEE).5 Internet of Things (IoT) communication between machines and machine-learning artificial intelligence (AI) deliver seamless processes, predictive maintenance and automatic corrective actions.

The pharmaceutical manufacturing environment is highly sensitive and tightly regulated. The smallest of errors can result in life-changing patient outcomes and have a disastrous commercial, legal and reputational impact on the manufacturer. For these reasons, Pharma 4.0 can often deliver amplified operational and competitive value.

A few years ago, a global pharmaceutical giant had to recall more than a half a million tablets because of packaging and human monitoring errors in the plant.3 Digitalisation and automation are now ensuring that the company will not experience a similar error in the future and suffer the financial ramifications and negative brand impact it suffered in the past.

The company has introduced digital sensors and robotics and invested in high-availability computing to guard against data-transfer issues between units. This has created a fully automated production line that has the by-product benefits of making it much easier to maintain cleanroom processes, capture and manage electronic batch records and analyse process performance (through root-cause analysis) to identify and implement improvements.

Further points of value for Pharma 4.0 are being gained in the field of regulatory compliance. One manufacturer has installed digital sensors for visual, environmental, temperature and chemical monitoring throughout its manufacturing process.6

This has now automated compliance reporting that previously involved expensive manual monitoring, although half-yearly manual tests are still made by an outside agency to audit and verify the automated reporting. Not only has this released crucial funds for investment elsewhere in the business, it has also provided the means for alerts when any of these factors move outside defined tolerances, triggering early intervention that minimises the cost of potential contamination, formulation errors and consequent process shutdowns.

Sustainable investment

It is now an industry wide expectation among manufacturers that new-generation digitalised technology will reduce costs and increase revenue as standard.7 Although the various dimensions of productivity differ between industries and countries, increased manufacturing productivity — the ability to either produce the same number of products for less or more products for the same cost — has a clear and calculable positive effect on costs and margins.

This effect can be measured using the Digitalisation Productivity Bonus (DPB), a financial model devised by Siemens Financial Services (SFS), which estimates the potential gains as a result of investment in digitalised Industry 4.0 technology.3,8

In the case of the UK pharmaceuticals industry, it is estimated that conversion to digitalised technology could deliver a DPB of between $9 and $1800 million.9 Whereas manufacturers in the pharmaceuticals sector may be aware of the many benefits associated with digitalisation, financial obstacles frequently delay or discourage investment.

Access to a range of smart and appropriate financing techniques is critical to a manufacturer’s ability to sustainably invest in the fourth-generation of digitalised technology and automation equipment.

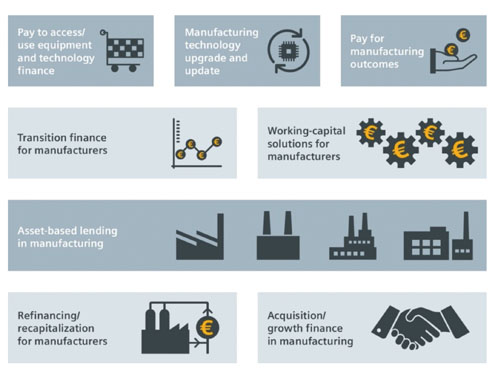

Figure 1: Examples of Finance 4.0

Finance 4.0 (Figure 1) covers a range of requirements from the acquisition of a single digitalised piece of equipment to financing a whole new factory. Financing techniques have now been developed to allow an end-user to, in effect, apply some or all of the DPB to fund the digitalised technology and equipment that makes the bonus possible in the first place.

In simple terms, these methods seek to align payments for next-generation technology with the rate of gain from the DPB. Broadly speaking, this can help to make the upgrade to digitalised technology affordable and potentially cost neutral (or better) for the end-user.

OEMs engaged in the manufacture of pharmaceutical machinery can leverage these benefits to drive sales by integrating Finance 4.0 into their overall offering and helping their customers to invest in new technology. Such finance arrangements tend to be offered by specialist finance providers that have a deep understanding of how the digitalised technology works.

Such financiers are able to work with OEMs to demonstrate how that technology can be practically implemented to deliver the DPB as well as other benefits of digitalisation to the pharmaceutical sector.

As the financing arrangement can be an embedded component of the value proposition, OEMs are able to introduce customers to the latest equipment and technology and simultaneously present them with a financially sustainable method to invest in digitalisation.

OEMs offering an integrated financing solution to their own customers have the potential to enhance their offering and remain competitive. In other cases, the technology provider will refer its customer to one or more finance providers to fund a sale.

Integrating finance into their sales proposition allows OEMs to facilitate investment in the latest equipment and technology and help customers to invest sustainably in Pharma 4.0. Complete solutions should be taken into consideration to identify the best finance package to effectively digitalise a manufacturing facility’s entire operation — from equipment to software to the production line to the whole enterprise. Between them, this range of Finance 4.0 techniques allows pharmaceutical manufacturers to access the Digitalisation Productivity Bonus.

References

- House of Commons, The impact of Brexit on the pharmaceutical sector: Ninth Report of Session 2017–2019 (17 May 2018).

- R. Schindler and C. Pollack, “Digitalization Benefits for the Machine Tool Industry,” Control Engineering (14 March 2018): www.controleng.com/articles/digitalization-benefits-for-the-machine-tool-industry.

- https://new.siemens.com/global/en/products/financing/whitepapers/whitepaper-the-digitalization-productivity-bonus.html.

- S. Gill, “Industry 4.0 and all that…,” Food Processing (16 October 2016): www.fponthenet.net/article/124535/Industry-4-0-and-all-that-.aspx.

- M. Ehrhardt and P. Behner, “Digitization in Pharma: Gaining an Edge in Operations,” Strategy& (19 October 2016): www.strategyand.pwc.com/media/file/Digitization-in-pharma.pdf.

- https://bit.ly/2M1VwtU.

- D. Newman, “Four Digital Transformation Trends Driving Industry 4.0,” Forbes (12 June 2018): www.forbes.com/sites/danielnewman/2018/06/12/four-digital-transformation-trends-driving-industry-4-0.

- The average bonus percentage range has been applied to the total annual revenue of the pharmaceutical manufacturing industry in selected countries across the globe (revenue data was taken from official third-party sources).

- Average DPB data derived from more than 60 interviews in 11 countries with international manufacturers, management consultancies and academic experts (expressed as a percentage of total revenues).

This article will appear in the June edition of Manufacturing Chemist. In the meantime, read more articles like this in our May issue.