The operational and cultural DNA of established medical technology companies has been steeped in rigid company processes that were created to minimise the risk of non-compliance with regulatory requirements such as FDA guidance. This is a very different picture from that of many new entrants and start-ups, which are using a more digital model to focus on lowering costs, increasing patient engagement and improving outcomes.1 These new developments are challenging established healthcare companies for shares of an industry that makes up about 10% of the global economy.2

In addition, regulators that have not been friendly to software products in the past have started to embrace new iterative development approaches to accommodate the growth of digital health.3 However, going digital has strained the current ways of doing business for many established companies. In fact, some recent examples have shown that success with digital products and services requires companies to rethink their business models and the underlying operational models. For two leading medical technology organisations, Roche Diagnostics and GE, we see a combination of business-model and operating-model change being used to deliberately alter how each company engages with the market. They have shown that to be more strategic when considering digital transformation, it is possible to create a simple yet comprehensive framework to think about these types of changes.

Roche Diagnostics saw insufficient outcomes from diabetes treatments, and decided that a more holistic approach was needed to manage the disease. To that end, it adopted an ecosystem approach to connect and offer integrated digital solutions to all stakeholders involved in the diabetes management cycle to optimise care processes and improve prevention. With this digital transformation, Roche went from only treating sick people in acute care settings to enabling treatment in chronic care and remote settings. In addition, it increased patient engagement to proactively assist in prevention by improving patient lifestyles.

GE has been a leader in driving digital transformation across its many businesses. A new division, GE Healthymagination (GEhM), was created for its healthcare business, with its own innovation operating model and supporting processes designed to develop new, disruptive business models in healthcare. Ultimately, GE created a new value proposition for various city and municipal governments, a market that GE Healthcare had not previously served. In addition, GE was able to extract more value through the increased sales of its products, as these were required to deliver on the value proposition.

Levers to impact digital change

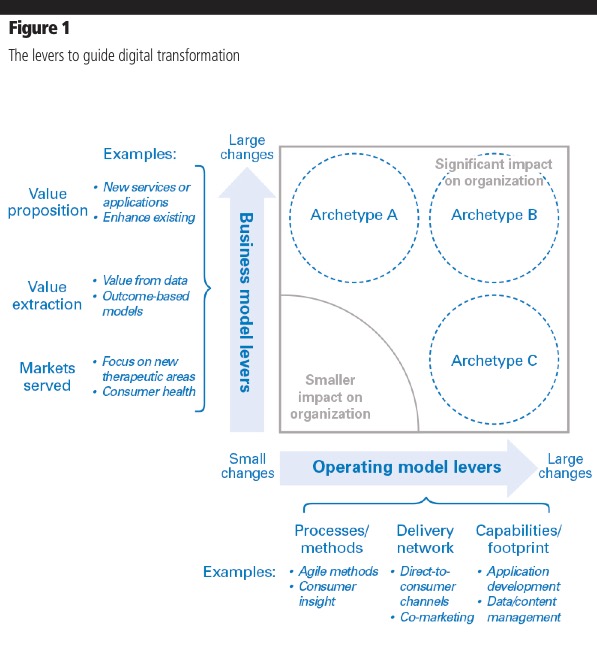

Based on our experience, and from assessing examples such as Roche and GE, we have identified two sets of primary “levers” that executives can use to impact the changes to their companies’ business and operational models that are necessary to support a digital enterprise (Figure 1). The specific levers used, and the degree to which they are “pulled,” will be unique to each company’s environment and its ultimate goals for digital. Most medical technology companies, including the examples cited above, will focus more on two or three of these, with minor changes involving the others.

Business model levers

Value proposition: Digital products and services can enhance or shift a medical technology company’s value proposition in the market. For example, it can extend its products to provide remote monitoring capabilities that improve care and reduce costs. Or it can offer tools such as applications and reminders to increase patient engagement and improve adherence. Typically, a digital business will want to build on the company’s existing core value proposition, rather than creating a new one.

Value extraction: Most medical technology companies have focused on selling devices or generating revenue per unit. However, the monetisation of value can take on alternative forms with digital, such as service-oriented models (selling hours of operation for a home health device versus the device itself, and data-centric models such as selling the data generated by the devices). These new models may require working with government payers and insurance companies to gain support for reimbursement.

Markets served: Digital can enable a company to shift or expand the markets it serves to open up new business opportunities. For example, digitally enabled products and services can be marketed to caregivers who are willing to pay for access to data on activity or medication adherence to give them peace of mind. Alternatively, companies may be able to create new business relationships with other value-chain players, such as home health companies, by providing information that improves the effectiveness and efficiency of in-home care delivery.

Operating model levers

Process/methods: Going digital requires new ways of working. Software development cycle times are faster and will be more effectively enabled by agile methods, which are fundamentally different from existing linear or phase-gate approaches employed by most medical technology companies. Robust technology and portfolio management methods are needed to keep up with the faster pace of technology change and ensure R&D resources are invested in the right areas.

Delivery network: Becoming digital can create opportunities for medical technology companies to engage with a broader ecosystem to develop offers and reach the market. The complexity and system-like nature of many digital-centric solutions creates attractive opportunities to engage development and/or delivery partners.

Capabilities/footprint: Adding digital elements to a portfolio will require new capabilities in areas such as application development, data management and security. In addition, medical technology companies will require capabilities in areas such as consumer insight and behavioural economics to ensure their digital health solutions meet patient/user needs and expectations. The organisational footprint should also be an important consideration to help gain technical talent or local market knowledge and access.

Case study: ResMed

ResMed is a producer of medical devices and cloud-based software applications that diagnose, treat and manage sleep apnoea, chronic obstructive pulmonary disease (COPD) and other chronic diseases, with $2.1 billion in revenue. Just as importantly, ResMed is a global leader in connected care, with more than 3 million patients remotely monitored every day. Its path to this position was deliberate and involved transforming multiple aspects of its business and operating models.

For Mick Farrell, the CEO of ResMed, the decision to go digital was not an option. “Digital or die — it’s an existential moment,” he recalls. “If we didn’t embrace [digital], we could go the way of others — as we’ve seen Netflix do to Blockbuster and Uber to taxis.” Thus, ResMed became committed to making the transition to a software-driven medical device company. After detailed modelling exercises to understand the value equation and investigate possible digital-enabled business models, Farrell and his team discovered “almost every time we could find value.” They launched their effort by including a communication capability in every device sold — it was not optional — and soon discovered they were creating increased value for all of their primary constituents.

For example, ResMed found that it could drive adherence for CPAP therapy devices from 50% (device alone) to 87% when patients were given a smartphone application, myAir, which helped them track their sleep-therapy progress. Each morning the patient received a “myAir score,” essentially gamifying sleep. Increased adherence reduced hospitalisations, which lowered costs and greatly improved the patient’s quality of life. ResMed also discovered that its connected devices decreased set up costs for home health providers by 59%, a significant value proposition.

By receiving nightly data on user performance (was the mask connected properly?) and compliance (was it used nightly?), the provider could focus its attention on users that were having issues, and reduce unnecessary outreach to patients doing well with their therapies. This digital capability has enabled ResMed to create a provider subscription service to access the software and data, and effectively changed the basis of competition for sleep-therapy devices.

ResMed also needed to transform its existing operating model to support the business-model changes. Farrell restructured the company to create a vertical business for software and services, which is now 7% of global revenue. A new, centralised health informatics function was established to cut across the entire organisation and support all businesses. ResMed also adopted agile development approaches to accelerate product-update cycles. Necessary skills were added by hiring cloud software engineers from other industries, in addition to some selective acquisitions.

ResMed is now widely considered to be a global leader in digital health and connected care for medical devices. As evidenced above, it made this transformation deliberately and systematically by identifying, analysing and pulling many of the available business-model and operating-model levers

Initial steps to get started

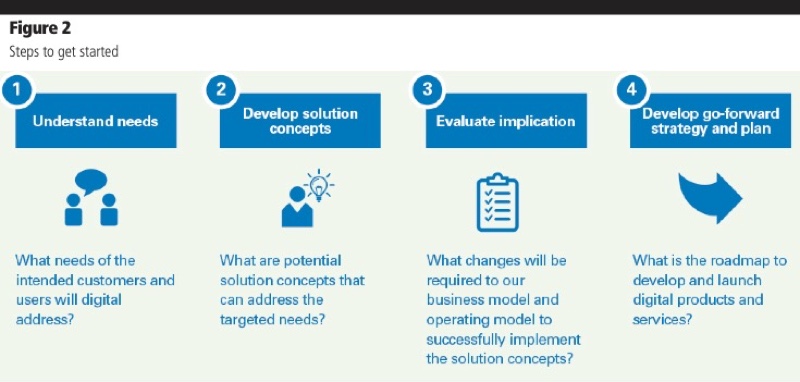

There is a clear set of initial steps that an established, analogue-native medical technology organisation should take to get started on a digital transformation (Figure 2). Even if an organisation has jumped into creating digital elements or dabbled in deploying a digital service, it will pay dividends to go through the steps to ensure there is strategic alignment between what the market needs and what the company does.

Step 1: Get a firm understanding of stakeholder needs, especially the latent needs of patients, users and other relevant players that are independent of the application of digital. What experiences do they currently have, and what aspects of those experiences can be improved? Are there areas of efficiency or cost that need to be addressed? The objective is not to develop or test solutions at this point, but to understand what needs, if addressed, will create value for the relevant stakeholders. After those needs are understood and rationalised to create a unique list, each is evaluated to determine which might be addressed by digital, and whether they make sense for the company to pursue. This step culminates in generating ideas to address the prioritised needs.

Step 2: Develop ideas into solution concepts, often with multiple ideas brought together into one concept. A concept here can range from a high-level scenario of a potentially new digital service offering to a more specific depiction of functionality being added to an existing medical device. In any case, there is a list of certain characteristics for each potential solution concept that must be identified, even if done with a higher degree of certainty, to inform the next step. At this point, it might be necessary to do a prioritisation of concepts. This step is an opportune time to start to seek out partnerships or employ a more open innovation model to help make progress and engage expertise not found internally.

Step 3: Evaluate the implications to the business model and underlying operating models for each prioritised solution concept. Different concepts can be compared, and the amount of change needed should be considered when determining the specific strategy to pursue. For example, if a concept will require significant changes to certain operating-model elements, such as existing IT infrastructure or long-term contractual relationships, then there may be a decision to forego that concept or to push it further out on a roadmap. Conversely, certain changes, such as a new monetisation model or market positioning message, might be very easy to effect and push some concepts forward faster. At this point, the archetype needed for the transformation will emerge.

Step 4: Only once the implications for the business model and operating model are understood can an organisation set its strategy and plan for going digital. Learnings from the implication assessment will impact the path forward and facilitate a more innovative way of thinking. For example, if the effort required to build new capabilities, technologies or processes appears high, then partnerships or acquisition might be the best strategy. By contrast, if the level of change is significant across the company, then perhaps the strategy would best be executed by setting up a new external entity.

Conclusion

There is significant value to be captured with digital products and services in the healthcare industry. Many new entrants are well positioned to compete because their models are oriented towards digital technology and software development — more so than existing, analogue-native medical technology companies, which are organised to comply with regulations. For these companies, going digital will require significant business- and operational-model changes.

References

- Arthur D. Little, Succeeding with Digital Health – Winning Offerings and Digital Transformation (March 2016): www.adlittle.com.pa/en/insights/viewpoints/succeeding-digital-health.

- World Bank Data (data.worldbank.org): In the United States, the world’s largest economy, health expenditure is more than 17% of GDP.

- As an example, see the US FDA’s Digital Health Software Precertification (PreCert) Programme at www.fda.gov.