As costs increase and budgets become squeezed, pharmaceutical manufacturers must constantly adapt their business model to mirror the shifts and trends in the marketplace. Expectations from the industry are rising: demand is higher, capabilities and resources must expand to accommodate diverse and multifaceted customer needs and standards must be met at varying levels, as products that meet standards for one regulatory body may not necessarily match those of another.

These are some of the findings of the latest in the series of CPhI Pharma Insights reports, which focuses on trends in manufacturing and process development. It says that industry hopes to see more continuous improvement models implemented over the next few years to mirror the growing need to drive greater manufacturing efficiencies and cost reductions.

Ensuring product quality, monitoring and improving safety within the supply chain and enhancing efficiencies are just some of the manufacturing puzzles yet to be solved

‘Looking ahead, there will be a need for more open collaborations between pharma, their suppliers and regulatory bodies to ensure that consistently high product quality is maintained and enhanced and manufacturing costs are lowered,’ the report says, suggesting that the industry may have to shift its model to become more patient-centric. ‘Ensuring product quality, monitoring and improving safety within the supply chain and enhancing efficiencies are just some of the manufacturing puzzles yet to be solved.’

The most important goals identified by the companies surveyed were improving product quality and reducing manufacturing costs. Given the number of recent quality issues reported and the growing challenge from the lower cost economies of China and India, this is not surprising, the report suggests.

However, CPhI expert industry panel member Girish Malhotra, President at EPCOT International, doubts whether the industry is actively following these goals through into manufactured products. ‘Industry simply has not walked the talk,’ he says. ‘Reducing manufacturing costs is a goal we all have, and most of the industry claims to aspire to, but as far as Big Pharma is concerned, profitability over the patent life means it’s not worth the time and money spent to make the reductions.

‘The industry is content with current levels and has not made an effort to further improve the profits. Generics also have cost reduction opportunities.’

Other goals that scored highly were improving time on delivery, improving responsiveness to customers and reducing product prices. Improving product supply and increasing innovation ranked lowest.

Given that improving product quality is the primary goal among respondents, it is somewhat surprising that 11% of them admitted that they do not test all incoming raw materials arriving at their facilities, in spite of the fact that half of those asked claimed to connect with suppliers on a weekly basis.

A previous report in the series, dealing with formulation and ingredients, identified a need for increased supplier auditing (either in-house or via a third party). However, although in that report 55% of respondents stated that the use of third-party audits was ‘extremely important’, 75.6% said they were not working with any third-party auditors.

‘Going forward, if manufacturers want to improve product quality, they must find a supplier that aligns with their own GMP compliance expectations to ultimately achieve this goal,’ this latest report points out.

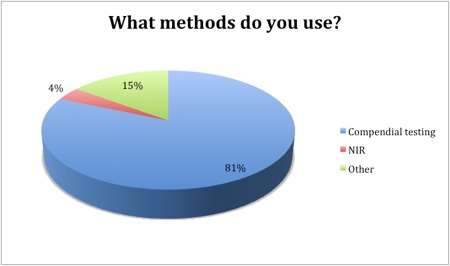

Of the 89% of respondents that are testing incoming raw materials, compendial testing was the method of choice (81%) and is likely to remain the principal approach over the next few years. Other methods (including gas chromatography, liquid chromatography and mass spectrometry) are being used by 15% of the industry to test sourced raw materials. Just 4% of the industry identified NIR as their method of testing.

The top manufacturing goals identified by respondents were improving efficiency and improving safety (both ranked at number one). Reducing cycle time, reducing setup time and reducing waste were all considered to be slightly less important, while increasing agility and reducing inventory were deemed the least important goals. But the report points out that if manufacturers were to prioritise the goals they ranked second and achieve solutions to reduce cycle time, reduce setup time and reduce waste, this would consequently improve efficiency.

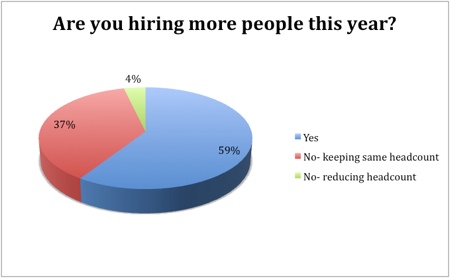

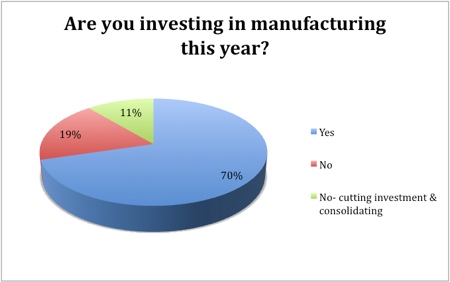

The outlook for growth in pharma manufacturing is largely positive, with 59% of respondents indicating that they would increase headcounts this year and 70% intending to invest. The headcount would remain stable in 37% of those asked, while only 4% said they would reduce the number of employees. Similarly, only a fifth had no intention to invest, while consolidation and reduced investment was on the cards for just 11%.

However, the report suggests that the latter figure could rise over the coming years. Market fragmentation and an increasing number of mergers and acquisitions, even among Big Pharma, means that consolidation may become a necessary action for companies to survive and thrive, particularly as the use of newer technology will be needed to further drive efficiency improvements. Some manufacturers have equipment that is 20 years old; but in the current market, there is no incentive to upgrade.

However, industry has acknowledged the importance of adopting processes and mechanisms to improve efficiency and streamline manufacturing processes to improve product quality. ‘We are seeing a desire by industry to increasingly adopt tools and methods to quantify the value and quality of their work and, consequently, adapt their manufacturing techniques to enable continuous improvement and improve product quality,’ the report says.

If companies had the complete command of the process from inception, quality might not become an issue and overall costs would be lowered

But the drive to cut corners without proper processes in place has been the cause of some of the quality issues that have surfaced across the industry. ‘If companies had the complete command of the process from inception, quality might not become an issue and overall costs would be lowered,’ Malhotra believes.

Where patented drugs are concerned, the problem is that there is little incentive to reduce costs, leading price control policies and healthcare payers to question the value of new therapeutics entering the market. ‘A solution whereby pharma finds an approach that marries the cost efficiencies of generics with the quality of branded products would produce increased access to drugs and a far more sustainable model,’ the report states.

In the medium to long term, it predicts, there is likely to be a cross-pollination of efficiency improvements stemming from generics, through to CMOs, which ultimately could, and should, permeate through to Big Pharma’s patented products. Lower cost patented drugs with bigger potential markets would provide the added benefit of reduced infringements and counterfeit products.

‘Process improvements could save billions in cost, lowering the price of drugs and opening up newer markets to pharma,’ adds Malhotra. ‘This has to be the short and long term goal. Process improvements made in existing approved products have to be approved by the regulatory bodies. Uncertainties of costs and time are an impediment for the industry to incorporate continuous improvements for the existing products. They give the industry a good reason to do nothing.’

He believes that the current manufacturing model is also an obstacle: ‘Regulatory bodies cannot drive excellence in companies. It is my hope that the industry will review the model and drive itself to excellence. Unless this happens, regulatory bodies through additional regulations will force the industry to drive to excellence. This will only increase costs.’

Taking all findings into account, the report says that manufacturers need to be more committed and willing to work more closely with both suppliers and regulatory bodies, particularly as the regulatory environment alters, to improve efficiently product quality and safety for patients. ‘As more continuous improvement models are implemented over the next few years, we are likely to witness improved efficiencies and significant cost reductions, which in turn should enable drugs to be more accessible across the globe,’ it concludes.