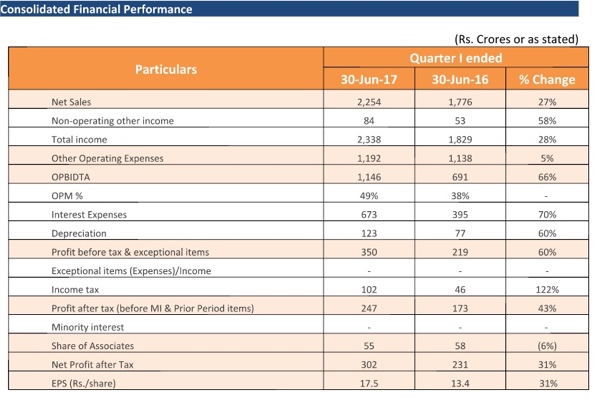

Financial highlights

- Revenue 27% higher at Rs.2,254 Crores during the quarter

- Net Profit 31% higher at Rs.302 Crores during the quarter

Operational highlights

- Loan Book increased by 79% to Rs.28,648 Crores as on 30 Jun 2017 as compared with Rs.15,998 Crores as on 30 Jun 2016.

- Successfully exited two Corporate Financing deals — Navayuga and Regen Infrastructure.

- Committed Rs.400 Crores across eight deals through the Emerging Corporate Lending vertical.

- Substantially completed the transition and integration of Gablofen (acquired from Mallinckrodt in the US).

- Global Pharma business cleared 7 regulatory audits and 58 customer audits.

- 24 new product offerings completed / in development in Healthcare Insight & Analytics business.

Ajay Piramal, Chairman at Piramal Enterprises, said: “We continue to consistently deliver excellent set of results quarter after quarter. The Company announced 27% growth in revenues to Rs.2,254 Crores and 31% increase in net profit to Rs.302 Crores for the first quarter of FY2018.

Our loan book continued to grow at an impressive pace at 79% to Rs.28,648 Crores, simultaneously maintaining a healthy asset quality. We continue to maintain strong focus on quality, compliance and risk mitigation across our businesses. We remain committed to deliver improved business performance and create sustainable long term value for all our stakeholders.”

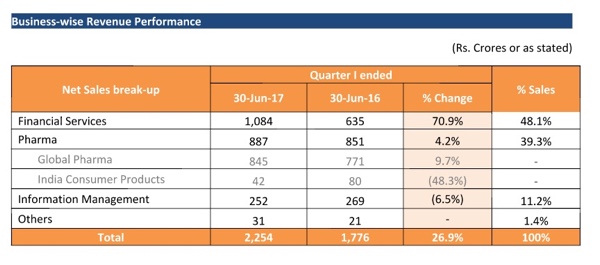

Consolidated revenues

Consolidated revenues for Q1 FY2018 were 27% higher at Rs.2,254 Crores as compared with Rs.1,776 Crores in Q1 FY2017. 47% of our Q1 FY2018 revenues were generated in foreign currency.

Net profit

Net Profit for Q1 FY2018 was 31% higher at Rs.302 Crores. Strong profitability was mainly on account of improved top-line performance in Financial Services and Pharma business.

Interest expenses

Interest expense for the quarter was higher primarily on account of increase in debt for making investments under Financial Services segment and for funding acquisitions in the previous year.

Share of profit / loss of associates

Income under share of associates for the quarter primarily includes our share of profits at Shriram Capital and profit under JV with Allergan, as per the new accounting standards.

Financial services

Income from Financial Services was 70.9% higher at Rs.1,084 Crores for Q1 FY2018.The growth in income was primarily driven by increase in size of Loan Book. Loan Book grew by 79% over last year to Rs.28,648 Crores. Construction finance now accounts for 59% of our real estate loan book. Gross NPAs reduced to 0.2% from 0.4% in Q4 FY2017. The Corporate Finance Group (CFG) successfully exited two large deals, Navayuga and Regen Infrastructure during the quarter. Senior lending which is now 46% of CFG portfolio is an outcome of realignment of focus to move down the risk curve. Also, two new external experts have joined the Deal Clearance Committee (DCC) of the CFG. We committed Rs.400 Crores across eight deals through our Emerging Corporate Lending (ECL) vertical.

Gross assets under management were at Rs. 6,727 Crores during the quarter. Investments made by APG under our alliance with them in Corporate Finance include total disbursements of Rs.970 Crores as on 30 Jun 2017. During the quarter, our JV with Bain Capital Credit (Distressed Investment Assets) received Alternative Investment Fund (AIF) license from SEBI.

Pharma

In Q1 FY2018, Pharma segment delivered revenues of Rs.887 Crores, as compared with Rs.851 Crores in Q1 FY2017.

Revenue from Global Pharma business was 9.7% higher at Rs.845 Crores in Q1 FY2018, primarily on account of strong performance in the product business largely due to ongoing integration of acquired products partly offset by global currency fluctuations and higher offtake during last quarter (lumpy nature of business). Capex for expansion at Digwal and Lexington is progressing well and enquiries for integrated projects at our services business continue to surge with many new projects in various stages of discussion. During the quarter, 20 new customers (including 7 large orders) were added in our services business.

Revenue from India Consumer Products was lower for the quarter due to channel de-stocking led by the new tax regime of GST. However, as per AC Nielsen, the consumer offtakes remains unchanged, indicating present situation to be merely a stocking issue. Key initiatives are being taken, to smoothly and swiftly transition to GST and business is expected to largely recover the revenue shortfall during Q1, in the next quarter. Lacto Calamine Oil Balance Face Wash and Face Scrub were launched during the quarter. Also, Indian film actor Manoj Bajpayee and Prosenjit Chatterjee (for Eastern India) got on-boarded as brand ambassadors for the recently introduced Polycrol Paan flavour antacid.

Healthcare insight & analytics

Revenue growth marginally declined in Q1 FY2018 to Rs.252 Crores, primarily due to shifting of existing business for the quarter to the next quarter and shift in timing of renewal of few annual contracts. The Company acquired Walnut Medical, a UK-based data company that will provide access to key European hospital-level data, to enhance and expand data and analytics offerings. It continues its focus on innovation and has 24 new product offerings, recently completed and/or in development.