Piramal Pharma Limited (NSE: PPLPHARMA | BSE: 543635), a leading global pharmaceuticals and wellness company, today announced its standalone and consolidated results for the Second Quarter (Q2) and Half Year (H1) ended 30th September 2024.

Key Highlights for Q2FY25

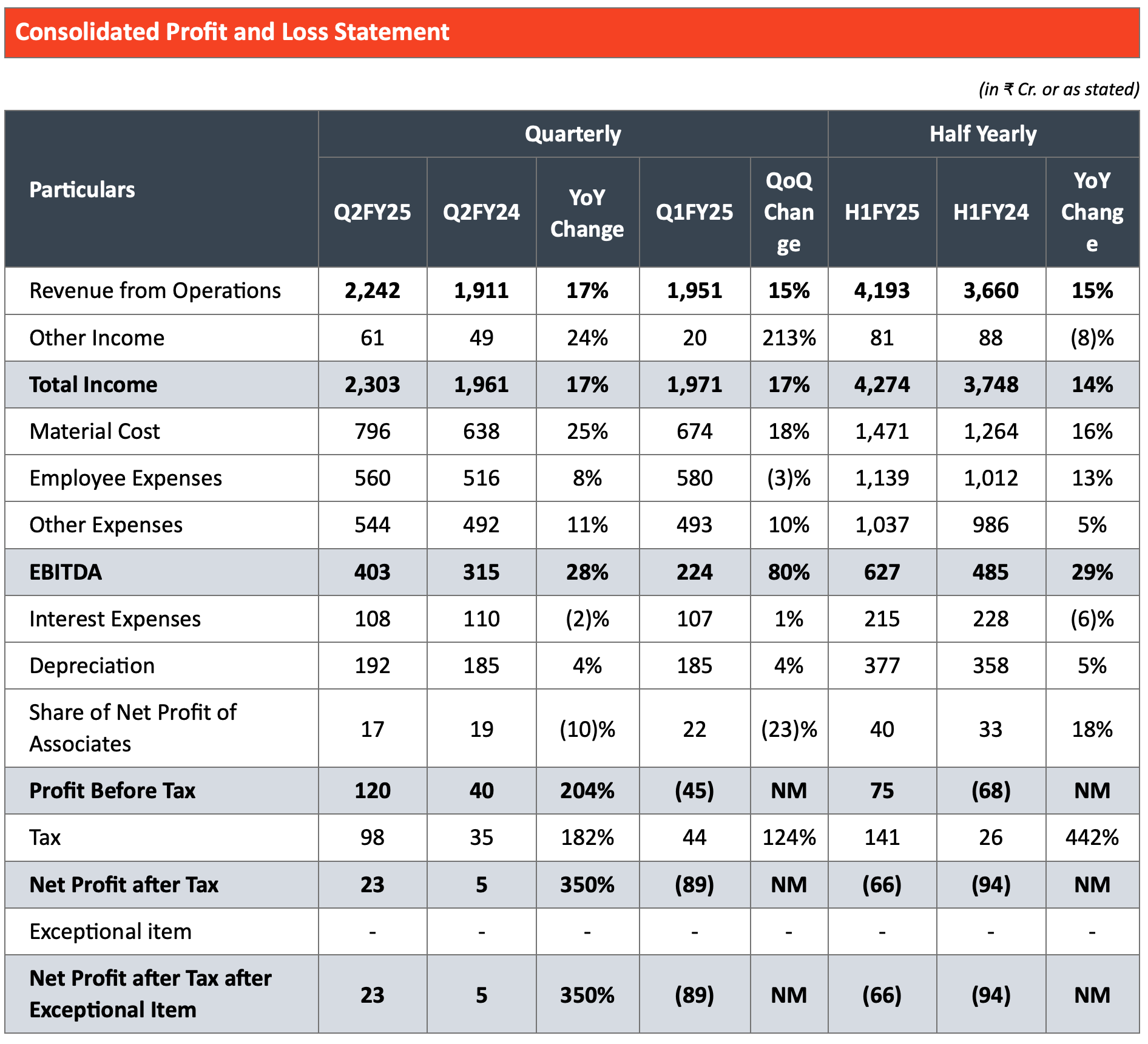

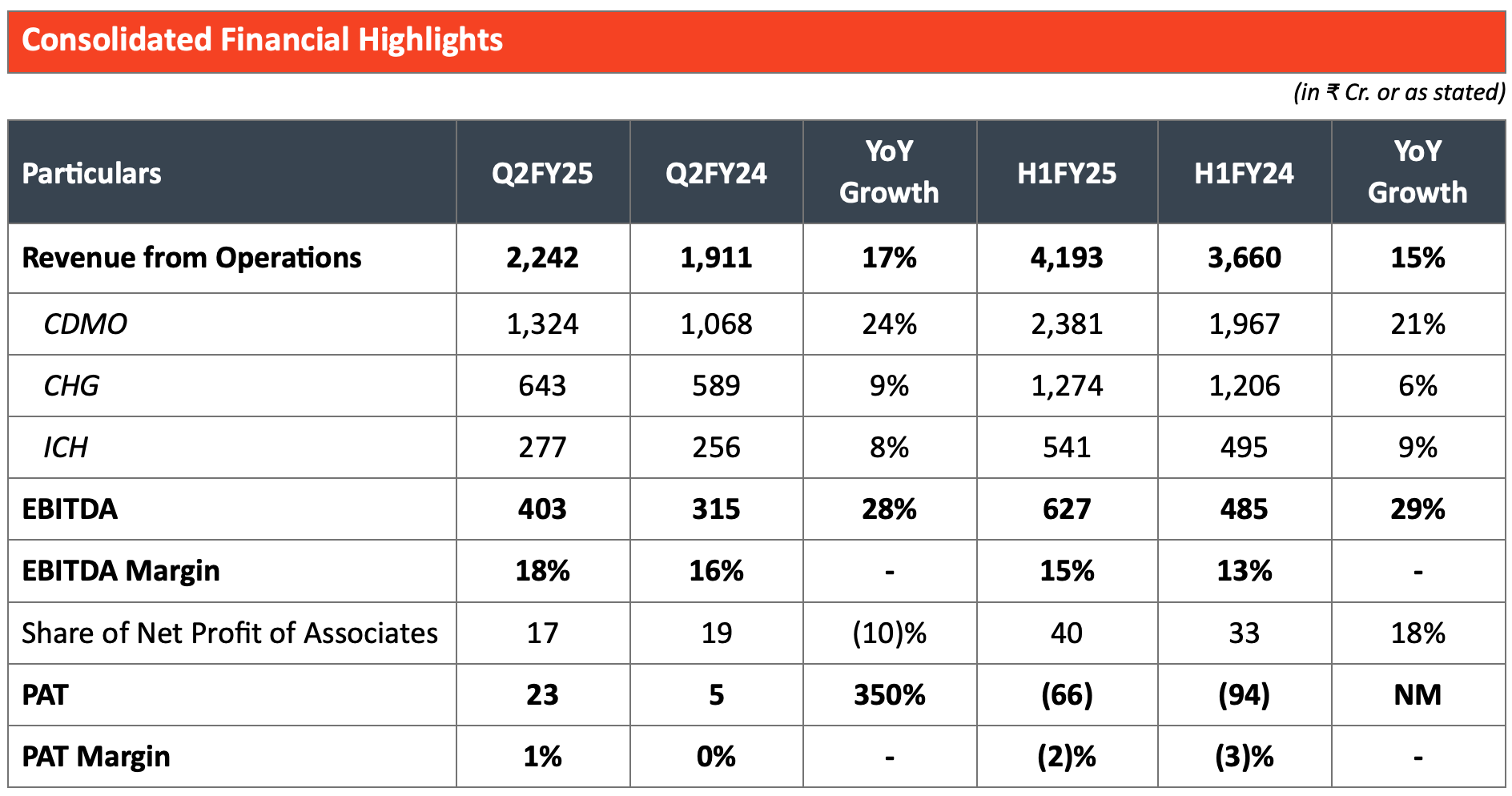

- Revenue from Operations grew by 17% YoY, primarily driven by robust growth in the CDMO business.

- EBITDA grew by 28% YoY with an EBITDA margin of 18%, a YoY improvement of approximately 150 bps, supported by operating leverage, cost optimization initiatives, and a superior revenue mix.

- Released the FY2024 Sustainability Report. The report follows GRI standards and aligns with SASSB and UNGC frameworks, highlighting a commitment to reduce GHG emissions in line with SBTi’s 1.5° decarbonization pathway.

Nandini Piramal, Chairperson of Piramal Pharma Limited, commented, “We continue our momentum of delivering healthy revenue growth accompanied by YoY EBITDA margin expansion, driven primarily by consistent growth in our CDMO business, which has witnessed a good pick-up in innovation-related work and on-patent commercial revenues. To sustain this growth momentum and capitalize on rising demand for sterile fill-finish capabilities, we have announced a US$80 million expansion plan at our Lexington facility, expected to complete by the end of FY27. In our CHG business, we are seeing steady volume growth in inhalation anesthesia products in the US and emerging markets. In our ICH business, we continue to see robust growth in our power brands and e-commerce sales.

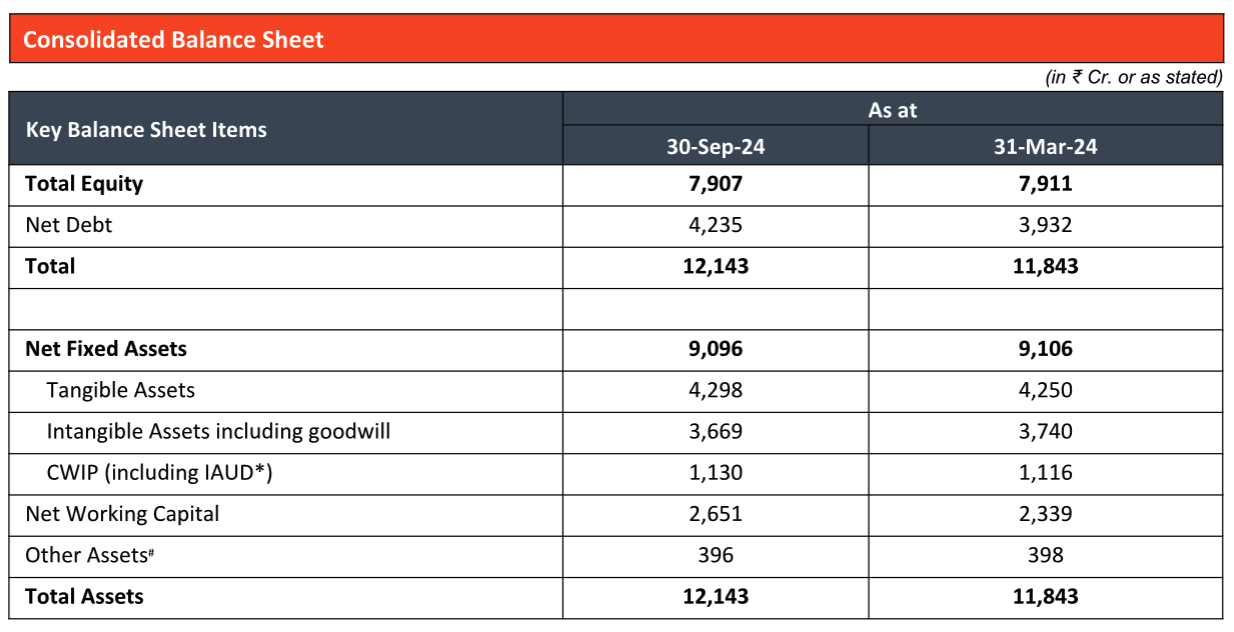

During the quarter, we released our Sustainability Report for FY24 under the theme ‘Building Resilience for a Sustainable Tomorrow,’ highlighting progress on our sustainability initiatives. Over the long term, we remain committed to achieving our financial goals of US$2 billion revenue with a 25% EBITDA margin and a 1x net debt/EBITDA ratio by FY30.”

Key Business Highlights for Q2 and H1 FY25

Contract Development and Manufacturing Organization (CDMO):

- Market outlook: Biotech funding has improved over previous years but remains uneven across months. Regulatory changes and supply chain diversification are driving an increase in customer enquiries and visits; however, decision-making by customers remains delayed.

- Targeted business development efforts are resulting in a steady inflow of new orders.

- YoY improvement in demand in the generic API business.

- Operating leverage and cost optimization initiatives are yielding continued YoY improvement in EBITDA margins.

- Maintained quality track record with the receipt of EIR for the PPDS facility (India), with zero Form-483 observations and an NAI designation.

- Customer-led US$80 million expansion planned in Lexington to more than double capacity and capture rising demand for sterile fill-finish capabilities.

Complex Hospital Generics (CHG):

- Strong volume growth in the inhalation anesthesia portfolio in the US and emerging markets.

- Capacity expansion at Dahej and Digwal is underway to capture growth opportunities in the RoW markets.

- Portfolio expansion underway, building a portfolio of differentiated and specialty products to drive long-term profitable growth.

- Multiple cost optimization and productivity enhancement initiatives in sourcing, manufacturing, distribution, and operational excellence are being pursued to maintain healthy EBITDA margins.

India Consumer Healthcare (ICH):

- Added 9 new products and 13 new SKUs to the portfolio during H1FY25.

- Continuing investment in media and trade spending to drive growth in power brands. Power brands grew by 18% YoY in Q2 and H1 FY25, contributing to 48% of ICH sales.

- Growth in the i-range has been adversely impacted due to regulator-mandated price reductions.

- E-commerce grew by over 30% YoY in Q2 and H1 FY25. Focus is on improving profitability in this channel through pricing, mix, and investment optimization.

- Plans to broaden reach from a pharmacy-dominant to an omni-channel consumer healthcare model. Transitioning successful online NPDs to offline, with general trade and modern trade-ready SKUs.