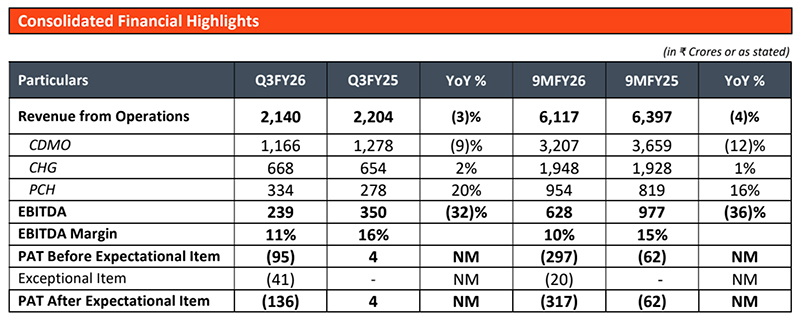

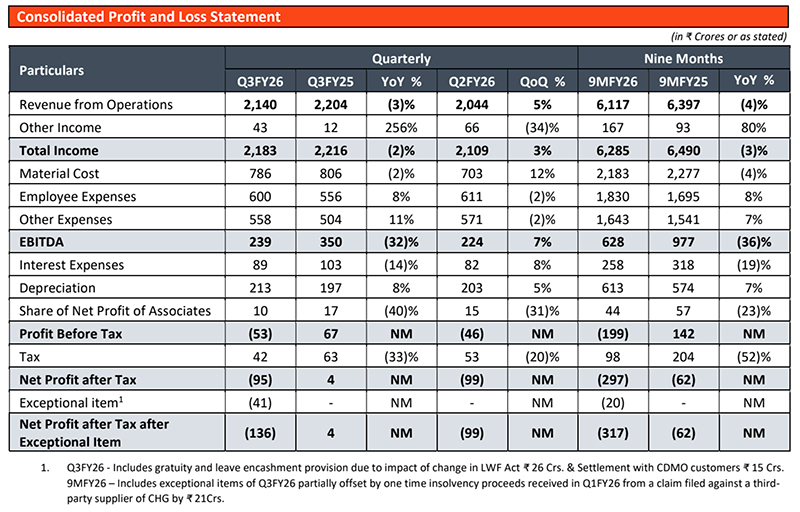

Key Highlights for Q3 and 9M FY26

- Revenue growth in Q3/9M FY26 was impacted by inventory destocking in one large on-patent commercial product by customer, slower early-stage order inflows in H1FY26 due to inconsistent recovery in US biopharma funding along with uncertainties on global trade policies, and regulatory delays in inhalation anaesthesia for ex-US markets from Digwal facility.

- EBITDA Margin – Despite lower revenues, impact on EBITDA was partly offset by our efforts towards cost optimisation and operational excellence.

- Seeing significant pick-up in RFPs with early signs of recovery in order inflows since October 2025 on the back of improved biopharma funding and increased M&A activities in the US.

- Growth Capex - US$ 90Mn investment to expand Lexington and Riverview facilities, on track. Seeing good customer interest.

Nandini Piramal, Chairperson, Piramal Pharma Limited said, “FY26 has been a muted year for the Company due to impact of inventory destocking and slower early-stage order inflows in H1FY26 in our CDMO business. However, in recent time, we are seeing early signs of recovery with pick-up in RFPs and order inflows on the back of improved biopharma funding and increased M&A activities in the US healthcare space. In our CHG business, we are investing in new products and expanding our presence in the ex-US markets. Acquiring niche brand like Kenalog, which is synergetic to our current business, is an important step in this direction. Our consumer business continues to outperform in its representative markets with robust growth in our power brands.

Despite the slower growth in FY26, we continue to believe in long term growth prospects of our businesses and back them with timely investments in capacities and capabilities. Q4 has been historically the strongest quarter for the Company, and we expect this trend to continue this year as well.”

Key Business Highlights for Q3/9M FY26

Contract Development and Manufacturing Organisation (CDMO):

- Biopharma funding in H2CY25 has shown signs of recovery with funding in H2CY25 close to double vs. H1CY25 and higher by over 50% vs H2CY24. Although, on full year basis CY25 funding was flat vs. CY24.

- Seeing significant improvement in RFPs along with uptick in order inflow since October 2025. Growth in orders from both large pharma and mid-size biotech companies.

- RFP/RFI trends for our overseas facilities with differentiated capabilities remained healthy. These sites have superior gross margin and scale up at these facilities can drive profitability going forward.

- Sustenance of biopharma funding along with faster decision making by the customers would be the key to healthy growth in FY27.

- US$ 90Mn investment to expand Lexington and Riverview facilities, on track. Seeing good customer interest for our North America sites, especially from those looking for onshoring.

- Maintained our Best-in-Class Quality Track Record - Successfully closed 30 regulatory inspections, including 2 USFDA inspections in 9MFY26. Continue to maintain our ‘Zero OAI’ status.

Complex Hospital Generics (CHG):

- Acquired Kenalog®

- Entered into an agreement to acquire Kenalog® from Bristol-Myers Squibb in an all-cash deal for upfront consideration of US$ 35Mn, and contingent consideration of up to US$ 65Mn.

-Kenalog® is a branded commercial injectable product with complex manufacturing requirements, complementing the CHG product portfolio. It is expected to generate EBITDA margin in-line with existing CHG business margins.

- Inhalation Anesthesia (IA)

- Growing faster than market in the mature US Sevoflurane market with value market share of 47% - up from 44% in MAT Mar’24. (Source:- IQVIA)

- Initiated Sevoflurane supplies from lower cost Digwal facility in RoW markets. However initial pick-up lower than expected due to regulatory delays.

- Intrathecal Therapy – Supply impacted in Q2FY26 have normalised. Maintained our #1 Rank in intrathecal Baclofen in the US with 75% value market share. (Source:- IQVIA)

- Injectable Pain Management – Initiatives to resolve supply constraints starting to yield results.

Piramal Consumer Healthcare (PCH):

- Power Brands grew strength to strength with 30% / 23% YoY growth during Q3 / 9M FY26, contributing to 51% of total PCH sales. Growth was primarily driven by Little’s, Lacto Calamine, CIR, and i-range.

- New Product Launches – Launched 31 new products and SKUs in 9M FY26.

- Invested about 12% of PCH sales in media and promotions in 9M FY26.

- E-commerce sales grew at 50% rate YoY in 9M FY26, contributing about 26% to PCH sales. More than 40% of e-commerce sales coming from quick commerce.

- Optimising Portfolio and Distribution Channel Mix - Focused efforts to grow profitable brands and distribution channels with better margins.

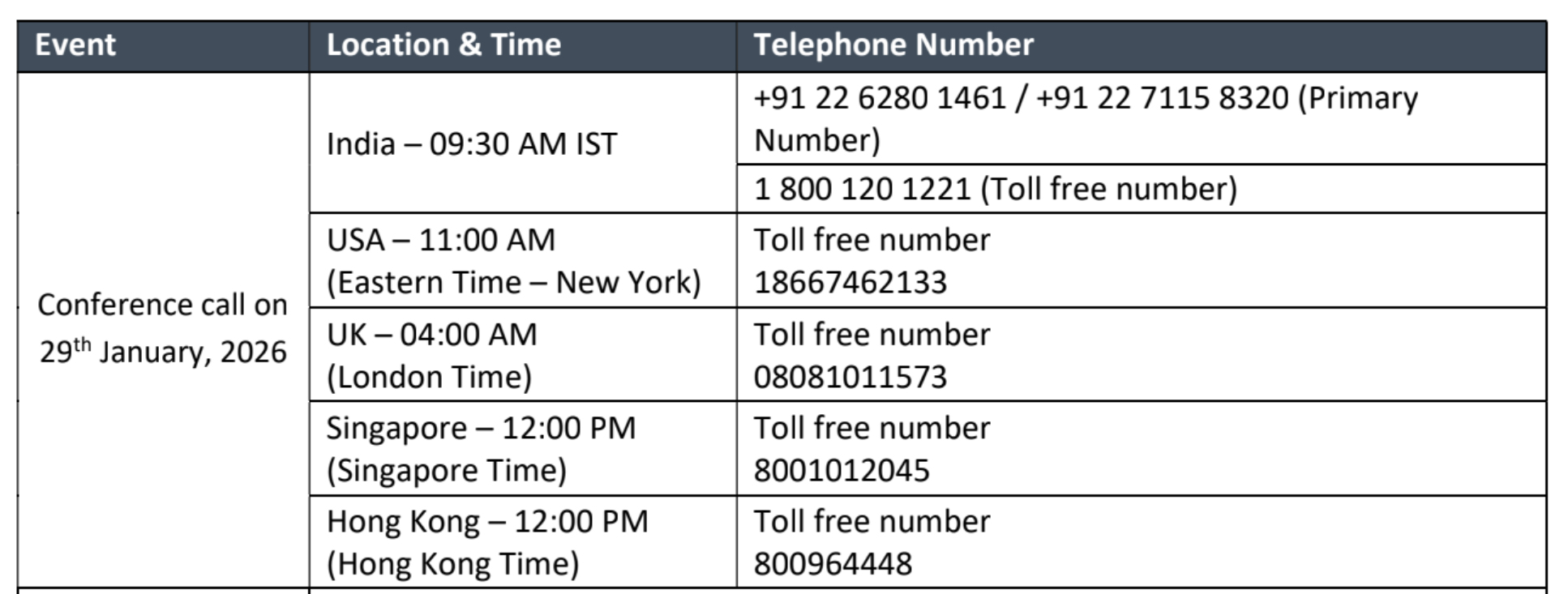

Q3 and 9M FY26 Earnings Conference Call

Piramal Pharma Limited will be hosting a conference call for investors / analysts on 29th January 2026 from 9:30 AM to 10:15 AM (IST) to discuss its Q3 and 9M FY26 Results.

The dial-in details for the call are as under: