Andrew Henderson starts the bidding by saying: “We have an ongoing growth strategy in place and we’re dedicated to continually investing in our facilities and building on our capabilities in line with customer demand. It’s an exciting time for us at the moment; our acquisition by GHO Capital will allow us to drive our plans forward and consider further investments in the coming years.”

Mark Quick comments: “Following a successful audit in January, we recently achieved ISO 45001 certification at our Wasserburg facility in Germany. The certification improves our sustainability standards, enabling the site to provide high quality health and safety to our employees. At Recipharm, we remain committed to continuous improvement and ensuring that operations across our global sites remain compliant with new and existing legislation. In turn, the ISO 45001 certification will be followed by more projects to further develop our efforts in this area throughout 2019.”

Says Manuel Leal: “As always, we will continue to gradually upgrade our manufacturing capabilities to be able to handle a wider range of products whilst improving our efficiency and speed to market.”

And Daniel Tedham adds: “As mentioned, we have developed, implemented and validated a new and unique system that allows our customers direct interaction with their products and stocks, facilitating late-stage customisation and allowing our services to act as an extension of their own operations. Additional projects, which are in their infancy, are also under way to work towards having completely seamless operation from customer to contract service provider and back across the life science sector.”

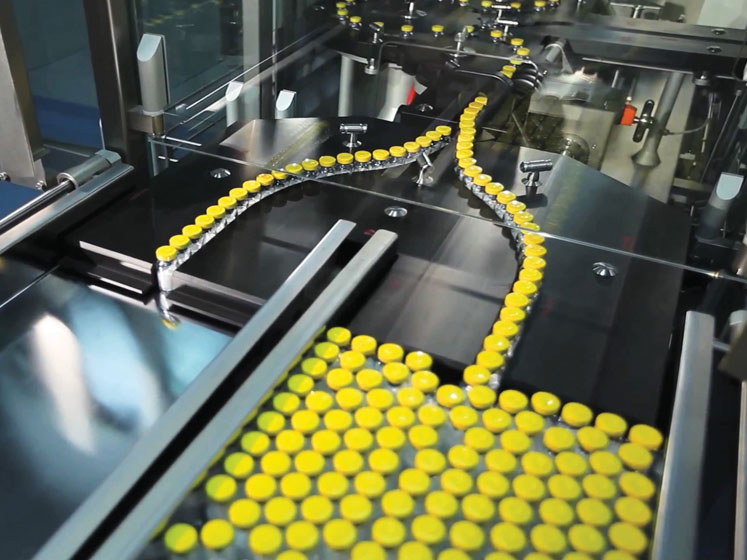

Dexter Tjoa concludes by saying: “In 2018, we invested heavily in our postponement service. As mentioned, we added a new line to our blistering capacity that’s equipped with late-stage customisation printing capabilities, taking our number of blistering lines up to eight. This year we’ll continue to expand our postponement service as well increase our ability to handle injectables, such as vials and prefilled syringes.”

Expertise and benefits

Asking about the benefits of outsourcing to contract service providers in the current market climate, Andrew notes: “The biggest benefit is the level of expertise that contract service providers can bring to a project. More often than not, CDMOs have had a broader knowledge of development and manufacturing challenges and are better equipped to overcome new ones as a result."

"In the area of hazardous chemistry, CDMOs can also bring specialist capabilities to the table that are often cost prohibitive to drug developers. The key is finding a reliable and flexible CDMO that can advise you on the best solution and help you to get the best results.” Mark agrees: “At a high level, outsourcing to contract service providers means that pharmaceutical companies are provided with specialised expertise, knowledge and capabilities.”

He continues: “CDMOs must actively adapt their operations to meet the evolving needs of the current market climate. For example, at Recipharm, we formed a dedicated taskforce to meet the serialisation regulatory requirements and invested €40 million into our operations to standardise our serialisation capabilities across key sites. As such, we successfully released our first batch of serialised products to the European market in 2018, well ahead of the 2019 deadline, meaning our customers had access to the capabilities to achieve compliance.”

Drug developers are interested in reducing time to market and costs through outsourcing. Providers of end-to-end drug development and manufacturing services can streamline the drug’s progress to market.

Says Mark: “This is because there is one company working on a project from start to finish, meaning a solid understanding of the drug substance and drug product can be developed. This pharmaceutical expertise, knowledge and understanding of potential hurdles can be used to facilitate an efficient manufacturing process. By providing a full-service offering, we can progress a drug to market with less supply chain complexity and, thus, more efficiently.”

“Specialism is key in our industry. If our clients were to make the investment into their own manufacturing facilities, they would have to dedicate huge amounts of resource and capital. Yet, by outsourcing, when demand arises for their product, they can leave it in the safe hands of a contract service provider whilst continuing to develop new products with little interruption,” says Manuel, adding: “Outsourcing can also offer benefits in terms of time to market, reduced costs, access to unique skills and support for your drug product within the supply chain by producing fruitful partnerships. As CDMOs focus on technology and processes, their clients can focus on the growth of their product portfolio and business development.”

Daniel feels that it allows companies to remain focused on their core competencies and minimise risk by not investing in new methods, equipment and processes internally prior to determining the true commercial volumes and the market/patient specifics. And Dexter suggests that outsourcing gives pharma and biotech companies the opportunity to focus on their core capabilities.

“In addition,” he says, “by outsourcing to expert providers, who have in-depth knowledge of services, they can get invaluable advice on the best solutions to reduce costs and time to market. Organisations with the right expertise can ensure that drugs reach patients in the condition that they are meant to and as quickly as possible, as well as ensuring that the best packaging solution has been selected.”

The rise of precision medication

Given that, traditionally, CDMOs have made money based on manufacturing large volumes, I posit how the emergence of more individualised medication might affect this model. “I don’t think we are going to see the production of large volumes disappear any time soon,” says Andrew, “but it’s true that the introduction of precision/personalised medication is emerging. As such, drug manufacturers may need to adjust their medicine manufacturing equipment and facilities to align accordingly with new drug pipeline requirements. Processes will also need to be adapted to handle what will inevitably lead to more complexity.”

“This may mean that CDMOs will need to shift their focus and manufacturing strategies from producing large volumes to more personalised and smaller batches in certain sectors, meaning flexibility will be a key consideration. Ultimately, precision medication and individualised medication will impact the downstream supply chain and cause disruption to currently used processes,” he adds.

“As we’ve mentioned, there are more and more complex medicines coming to the market. Many of the oncology treatments, for example, require low manufacturing volumes and a high degree of expertise, such as containment capabilities for HPAPIs and agile manufacturing methods. For traditional CDMOs who manage large volumes, these products are very complicated to handle."

"Yet, this is precisely our focus at Idifarma — to manufacture niche and highly potent products. We specifically designed our facilities to produce these sorts of products. For this reason, companies will look to outsource their products to a variety of CDMOs depending on specific requirements,” says Manuel.

Taking a contrary position, Daniel doesn’t believe the previous comments to be true. “From my experience, large volumes were frequently kept in-house by most large pharmaceutical companies as they are able to dedicate the required capital expenditure to implement automated production lines and have them largely dedicated to just a handful of SKUs."

"In comparison, the smaller volumes or products that were more challenging were contracted out — as CMOs are better placed and have the experience to offer solutions for more challenging products. The model therefore remains the same; however, CMOs need to be offering a more holistic service that provides solutions from the start to the end of the supply chain. This minimises the complexity and costs associated with transferring a product across a number of different vendors and allows revenue to be generated and spread across each stage.”

Adding to the discussion, Dexter states: “For CPOs and CDMOs, packaging large volumes of generics is not actually high value contract packaging work … and companies are starting to realise this and adopt alternative operating processes to cater for smaller volumes."

"For us, low volume, high value projects are just as important as big volume generic ones; and, with more medicines targeted at specific patient populations, I expect this will be the case for many companies. CPOs that already have both the ability and the expertise to handle small volume, complex products will be in high demand given the current drug pipeline. CPOs that do not currently have these capabilities will have to invest in the future as precision medications continue to be developed.”

Bonding with biotechs

Drawing the debate to a close, I ask the panellists whether CDMOs have the right skillset to work with small biotechs. “Yes,” says Manuel, “specifically small to mid-size CDMOs. Small biotech companies often look to partner with organisations who have similar decision making and quick response times, making small CDMOs the best fit as these traits can be hard to come by in larger contract service providers.”

“By contrast,” he adds, “it’s important for small biotech companies to find CDMOs that have no conflicting interests. For example, when a CDMO has its own portfolio of products, there could be instances when the client might not have equal access to the manufacturing capabilities compared with the CDMO’s own products. Therefore, CMDOs that can tailor their services to each client become the most attractive option for these biotech companies.”

Daniel agrees: “Absolutely. The level of experience that CDMOs have gained from working with a wide variety of products and customers brings huge benefits when outsourcing what, in theory, are more complex products. Contract service providers are well versed in bringing new products in, acquiring the necessary equipment, implementing new processes from initial conception through to product launch and continuing commercial supply."

"Trying to buy in or invest in that kind of training would be almost impossible from both a financial and time perspective, so it’s best to work with the companies that do it every day.”

In conclusion, Dexter adds: “Yes. It’s vital that they explore novel technologies to find new and improved ways of working that allow them to effectively cater for small volume products. What works for generics won’t always work for small biotechs, as biologic drugs may need temperature-controlled storage environments or have shorter shelf-lives, which means they must reach patients faster. CPOs who already have these capabilities will be well placed to cater for new medicines entering the supply chain during the coming years.”

Part I of this article is available here.

Read more articles like this in the May issue of Manufacturing Chemist!